When you first saw an envelope in your mailbox labeled “You’ve been pre-approved,” you might have thought it was skepticism. But the closer you look you see something interesting, it directed you to a site called accept.creditonebank.com with an approval code printed inside. If you’ve received one of these, you’re probably wondering: What exactly is this, and is it legit?

Well, to put it simply, this is Credit One Bank’s way of offering you a pre-approved credit card deal. That approval code is unique to you. It’s a special invite, meaning they’ve looked at basic information from your credit profile (through a soft inquiry) and believe you might qualify for one of their cards. It’s like getting a golden ticket but you still need to use it right to get through the gates.

You enter the code at accept.creditonebank.com, and the system quickly verifies your identity and checks deeper into your creditworthiness before offering you a final decision.

And here’s the cool part: It doesn’t impact your credit score unless you officially apply and accept the offer. So, yes it’s kind of a risk-free peek into whether you could get a card with Credit One.

- Milestonecard.com/activate – How to Activate My Milestone Credit Card

- Firstnationalcc.com Accept – How to Accept a Credit Card Offer

- www.aspirecreditcard.com Acceptance Code – Aspire Credit Card

- Comenity.com Login Zales – Login to Zales Credit Card

- Openskycc.com/activate – Activate Your OpenSky Credit Card Online

- OneMain Financial Brightway Credit Card – Benefits, Features & Application

- Cerulean Credit Card Login – Secure Online Account Access

- Navy Federal Credit Card Prequalification: What You Need to Know

- Best Time to Apply For Navy Federal Credit Card

- Indigocard com Activate – How to Activate Your Card

- www.speedyrewards.com Register Card – Get Speedway Rewards

- Apply.credit9.com – Get Started with Credit9 Now

How the Pre-Approval Process Works

Now, you might think that “pre-approved” means guaranteed. But it doesn’t, there’s a little more to it. The pre-approval process is Credit One Bank’s way of saying, “Hey, based on what we know so far, we think you’d be a good candidate.” But it’s still a soft inquiry at this stage not the full credit check.

Soft Pull vs Hard Inquiry Explained

The approval code you receive triggers a soft pull. That means Credit One just took a surface-level look at your credit file. It doesn’t affect your score at all. You can check these kinds of offers all day without a dip in your rating.

However, once you enter the approval code at accept.creditonebank.com and move forward with an actual application, then Credit One does a hard pull this is where they dive deeper into your financial history. A hard pull can lower your credit score by a few points, temporarily.

Does Pre-Approval Guarantee Approval?

No pre-approval is not a promise. Think of it like a “You’re invited” RSVP rather than a signed contract. Once you enter your code and confirm your information, they’ll either approve you, deny you, or offer you a modified deal based on your actual credit profile.

That said, if you’ve received the mailer, your chances are much higher than someone applying cold. Just make sure your details line up with what they pulled during the soft check. A big difference in income or credit history could throw things off.

How to Use Your accept.creditonebank.com Approval Code

Alright, let’s get down to the practical stuff. You’ve got your code, and you’re ready to see what’s behind the curtain. Let me walk you through exactly how to use that accept.creditonebank.com approval code to check your offer.

Step-by-Step Instructions

- Open your browser and go to accept.creditonebank.com.

- Enter the approval code you received in the mail. It’s usually 12 digits, sometimes a mix of letters and numbers.

- Provide some personal details, including your name, address, and Social Security Number. This helps verify your identity.

- Review the offer you’re presented with. Check the APR, fees, credit limit, and rewards program.

- If you like the offer, hit “Accept” and submit the application. This is when the hard pull happens.

- You’ll get an instant decision in many cases. If not, they’ll follow up by mail or email.

Common Mistakes to Avoid

- Typing errors in your code: one wrong letter and you’ll get an invalid response.

- Submitting outdated codes: these are often time-sensitive, so don’t wait too long.

- Using someone else’s code: the code is tied to your credit profile only.

- Applying with incorrect personal info: make sure everything matches your current credit report to avoid unnecessary rejections.

What Happens After You Enter the Code

Now you’ve submitted your details and entered the code what next? Let’s talk about what you should expect from here.

What to Expect from Credit One Bank

After submitting your approval code on the Credit One website, one of three things typically happens:

- You’re instantly approved: This is the best-case scenario. You’ll see the details of your credit card offer, including your credit limit, APR, and any bonus programs.

- You’re conditionally approved: Sometimes they’ll ask for more documents, like proof of income or identity verification. Don’t panic it’s pretty normal.

- You’re denied: This can happen if your recent credit activity has changed or doesn’t align with the initial soft inquiry.

When Will You Receive Your Credit Card?

If approved, you can usually expect your Credit One card to arrive within 7 to 10 business days. Along with it, you’ll receive terms and a welcome guide. Make sure to read through everything before activating the card.

You’ll also get access to Credit One’s online account portal, which is essential for managing your spending, checking balances, and making payments.

Benefits of Credit One Bank Cards

Credit Building Opportunities

One of the main selling points of Credit One cards is that they report to all three major credit bureaus. That’s a big deal because it means every on-time payment and responsible credit use helps strengthen your credit score.

Even if you’re starting with a low credit limit, using your card responsibly (like keeping balances under 30% and paying off in full) can really work in your favor.

Rewards, Cashback, and More

Some of the Credit One offers even include 1% cashback on purchases like gas, groceries, and mobile services. It’s not the highest rate out there, but hey it’s better than nothing.

Also, they provide fraud protection, custom alerts, and free credit score tracking, which are big bonuses if you’re trying to stay on top of your finances.

Diving Deeper Into Credit One Bank Services

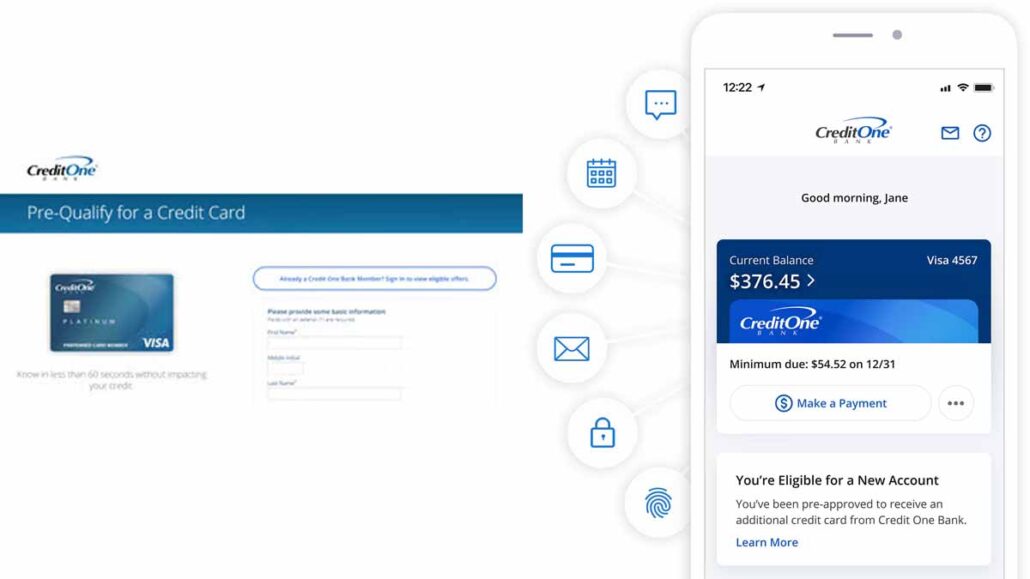

What Is Credit One Bank Online Account Access?

Once you are approved and have received your Credit One card, the very first thing you need to do is set up your online account access. Trust me, this part is a game-changer. It’s not just about checking your balance. It’s a whole portal where you can manage every aspect of your account right from your phone or laptop.

To get started, visit the official site and clicked on “Set Up Online Access.” They asked for some basic info: your account number, Social Security number, and ZIP code. Within a few minutes, you’ll create a secure username and password.

Now, you can log in anytime to do things like:

- Check your current balance and available credit.

- View recent transactions and billing statements.

- Schedule or make payments.

- Set up autopay (which is highly recommend to avoid late fees).

- Get alerts about due dates, suspicious activity, or promotional offers.

One thing I like is that they also give you free access to your Experian credit score. It’s updated regularly and helps me keep track of my credit-building journey.

If you’re the type who wants to stay in control of your money and credit progress, the Credit One online portal is your best friend. And yes, it’s also available as a mobile app on Android and iOS, so you don’t always need a computer.

How Do I Apply for a Credit One Bank Credit Card?

Whether you’ve received a pre-approval offer or not, applying for a Credit One card is pretty straightforward. Let me explain both scenarios so you can figure out the best route for you.

With a Pre-Approval Code

If you’re lucky enough to get a mailer with an approval code, head straight to accept.creditonebank.com. This is the easiest route because Credit One has already done a soft pull and thinks you’re likely to qualify.

Follow the prompts, enter the code, verify your identity, and review the offer. If everything looks good, submit your application for a final review.

This route typically results in faster decisions and, honestly, better offers in terms of APR and fees.

Without a Pre-Approval Code

No code? No problem.

You can still apply by going directly to creditonebank.com and clicking on the “See If You Pre-Qualify” option. This also uses a soft credit pull, meaning no impact on your score.

Once you go through the short form, they’ll show you any cards you might qualify for. If you decide to proceed, that’s when they perform the hard inquiry and give you a final answer.

Keep in mind, not having a pre-approval code doesn’t mean you won’t get approved. It just means you’ll need to go through the full evaluation process without the initial boost of Credit One’s prior screening.

Understanding Credit Limits and Usage

Credit limit was a big concern for me. If you’re asking, “What is the credit limit for Credit One up to $2000?” you’re asking the right questions.

What Is the Credit Limit for Credit One Up to $2000?

Credit One typically offers starting limits between $300 and $2,000, depending on your credit profile. If your score is fair or on the lower end, you might start with something modest like $300 or $500. But don’t stress that’s just the starting point.

If your credit score is a bit higher (in the 600s or up), and your income looks stable, you could land a starting limit of $1,500 or even $2,000. They don’t usually publish exact criteria, so it’s evaluated case-by-case.

Remember: your initial limit isn’t permanent.

How to Increase Your Credit Limit Over Time

Once you’ve had your Credit One card for a few months and you’ve been making on-time payments, you may be eligible for a credit line increase.

Here are a few tips to increase your limit:

- Always pay on time even better, pay early.

- Keep your utilization low try not to use more than 30% of your available credit.

- Don’t max out your card even if you pay it off each month.

- Enroll in autopay to never miss a due date.

- Wait for an offer Credit One sometimes automatically increases your limit if you demonstrate responsible usage.

Credit Protection & Security Features

Credit cards always come with a little risk. What if someone steals your info? What if your card gets lost? That’s why Credit One’s protection features are so valuable.

How to Activate Credit Protection on Credit One

Credit One offers an optional Credit Protection Program you can enroll in. Once activated, this program may cancel your minimum payment or even suspend late fees for a set period if you experience a life event like:

- Job loss

- Hospitalization

- Disability

- Death (applies to your estate)

To activate, you’ll need to:

- Log in to your online account.

- Navigate to the Credit Protection tab.

- Enroll and review terms carefully.

- Pay a small monthly fee (usually a percentage of your balance).

It’s optional, but for some people especially if you’re just getting back on your feet financially it adds a nice layer of security.

Other Security Benefits They Offer

Besides credit protection, Credit One cards come with features like:

- Zero Fraud Liability: You won’t be held responsible for unauthorized charges.

- Real-time alerts: Text or email alerts for unusual activity.

- Account lock/unlock: Temporarily disable your card if it’s lost or stolen.

- EMV chip: Makes in-person transactions more secure.

All in all, Credit One makes security a priority, which gives you some peace of mind after activating your card.

Enrollment and Customer Support

Do I Need to Enroll in Credit One Programs?

You don’t have to enroll in every program they offer. But it depends on what you want out of your card experience.

When you enrolled in:

- Autopay to avoid missing payments.

- Credit score monitoring (which is free).

- Credit protection program for added safety.

You can also choose to opt-in for email updates, text alerts, and other communication settings based on what you prefer.

How Do I Contact Credit One Bank?

When you need help, especially with tracking your card after approval, you can contact Credit One’s customer service.

Here are your main options:

- Phone: Call their support line.

- Online Chat: Available on their website during business hours.

- Secure Message: Send a message from your online account.

- Mail: You can also reach them by traditional mail if needed, though this is the slowest method.

Pro tip: Have your account number ready when calling or messaging to speed up the process. Also, their app has a great “Help” section with instant FAQs and tools for card management.

Additional Insights About Credit One Bank Approval

Is Credit One Pre-Approval Legit?

Yes, Credit One pre-approval is legit.

Let’s break this down.

How to Verify the Offer

The pre-approval you get is based on a soft credit inquiry meaning Credit One looked at your credit file just enough to make an informed guess about your eligibility. The offer usually comes with an approval code, and you’re asked to go to accept.creditonebank.com to see your deal.

Once there, you’ll enter your code and some basic personal info. It’s a secure site, and as long as your credit situation hasn’t changed drastically since the soft pull, there’s a strong chance you’ll be approved.

Here’s a tip: check that the mailer has your correct name, the website URL is secure (look for the padlock in your browser), and the envelope hasn’t been tampered with.

How This Impacts Your Credit Score

The pre-approval itself does not affect your credit score. It’s a soft pull.

However, once you decide to move forward and officially apply for the card, Credit One will perform a hard inquiry. That can lower your score by a few points temporarily usually no more than 5-10 points.

But here’s the upside: if you’re approved and you use your card responsibly, you can build or rebuild your credit, which is the real goal. For many people, especially those with less-than-perfect credit, this card can be a stepping stone.

Did I Get Approved for Credit One?

Wondering “Did I get approved for Credit One?” Don’t worry, It can be nerve-wracking, especially when you hit “Submit” and aren’t immediately told “You’re approved!”

Here’s how to know for sure where you stand.

Signs You’ve Been Approved

Once you enter your accept.creditonebank.com approval code and go through the application, you’ll usually get one of the following results:

- Instant Approval: You’ll see a message right on the screen saying you’ve been approved. It will often tell you your credit limit, APR, and when you can expect your card.

- Pending Review: If they need to verify something (like your income or address), your application might be under review. You’ll usually receive an email or letter within 7–10 business days with a final decision.

- Approved But Card in Transit: Sometimes you’re approved, but they won’t show the card details online. In that case, just wait for the mail.

If you’ve waited more than 10 business days without hearing anything, I’d recommend calling Credit One.

What to Do If You’re Denied

Rejection stings, but it’s not the end of the world.

If Credit One denies your application, they’ll send you an adverse action letter explaining the reason. Common reasons include:

- Low credit score

- High debt-to-income ratio

- Recent delinquencies

- Inconsistent application information

Don’t be discouraged. You can still:

- Work on improving your credit

- Pay down debt

- Apply again in 6 months

Meanwhile, consider secured cards or credit builder programs that report to credit bureaus.

How Do I Get a Credit One Pre-Approval Code?

If you didn’t receive an approval code in the mail but still want one, there are a few ways you can increase your chances of getting on Credit One’s radar.

Requesting a Code from the Bank

Currently, Credit One doesn’t let you request a pre-approval code directly. However, they do allow you to see if you pre-qualify online, which essentially works the same way.

Here’s what to do:

- Visit creditonebank.com.

- Click on “See If You Pre-Qualify.”

- Fill out your name, address, SSN, and income details.

- Submit and view your offers (if any).

If you qualify, they might email or mail you an approval code later for a specific offer.

Eligibility Criteria for Receiving One

Credit One targets individuals with:

- Fair to average credit (scores between 580–700)

- Some credit history (they rarely offer cards to those with no credit file)

- Stable income or employment

- Responsible recent activity (no recent bankruptcies or charge-offs)

To improve your odds of getting a code in the future:

- Keep your credit utilization low

- Pay your current bills on time

- Avoid opening too many new accounts at once

- Eventually, Credit One or another issuer may send you a tailored offer.

How Do I Find My creditonebank Approval Code?

Lost your code? Accidentally tossed that mailer into the recycling bin? Don’t worry, you’re not alone. Here’s how you can find your creditonebank approval code if you’ve misplaced it.

What to Look for in the Mail

The approval code is usually located:

- In bold text on the top portion of the offer letter

- Next to or beneath the URL: accept.creditonebank.com

- Sometimes printed above your name or customer ID

It’s typically a 12-character alphanumeric code (like AB12-CD34-EF56).

If you still have the envelope, double-check both sides. Some offers even include the code twice—once on the letter, once on the tear-off slip.

Online Retrieval Options

Unfortunately, Credit One doesn’t currently offer an online lookup tool for lost approval codes. If you can’t find it anywhere:

- Call Credit One and ask if they can resend the offer.

- Try pre-qualifying online through their main site.

- Wait for another mailer they often send offers out every few months.

FAQs

Is Credit One pre-approval legit?

Yes, it is. Credit One Bank uses a soft pull to pre-screen your credit and determine if you’re likely to be approved. If you receive an offer with an approval code, it’s based on actual credit data, and your odds of final approval are high as long as your current info aligns with what they pulled.

What is the credit limit for Credit One up to $2000?

Credit One typically offers starting credit limits between $300 to $2,000, depending on your credit profile. Factors like income, debt, and payment history play a big role. Many users report starting at $500 and working up to higher limits through responsible use.

Did I get approved for Credit One?

You’ll know you’re approved if:

- You receive an on-screen approval message after applying.

- You get a confirmation email or mailer with card details.

- Your card arrives within 7–10 business days.

If you don’t hear back, call the phone number to check your application status.

How do I activate credit protection on Credit One?

Log into your online account and go to the Credit Protection section. Follow the instructions to enroll. This optional program helps cover minimum payments during emergencies like job loss or hospitalization. There’s a small monthly fee based on your balance.

How do I get a credit one pre-approval code?

Credit One sends these by mail based on your credit profile. To increase your chances:

- Keep your credit in good shape.

- Avoid missed payments.

- Try the “See if you pre-qualify” tool on their website.

How do I Find my creditonebank approval code?

Look on the mailer you received, it’s usually bold and near the top or next to the accept.creditonebank.com URL. If lost, you can:

- Call Credit One’s customer service.

- Wait for a new offer.

- Try pre-qualifying online.

What is credit one bank online account access?

This is your personal dashboard to manage everything related to your card:

- Check your balance.

- Pay your bill.

- View transactions.

- Track your credit score.

- Set alerts and controls.

You can access it via their website or mobile app.

How do I apply for a credit one bank credit card?

If you have a pre-approval code, go to accept.creditonebank.com and enter it. No code? No problem. Visit creditonebank.com, use the pre-qualification tool, and follow the prompts to apply.

Do I need to enroll in the credit one bank program?

Not necessarily. Enrollment in features like autopay, credit protection, and alerts is optional but highly recommended for staying on top of your account and avoiding missed payments.

How do I contact credit one bank?

You can reach them through:

- Phone

- Online Chat: Available on their website

- Mail: Credit One Bank, P.O. Box 98872, Las Vegas, NV 89193-8872

- Secure Message: Through your online account

Conclusion

If you’ve received a Credit One Bank pre-approval offer in the mail with an accept.creditonebank.com approval code, you’re already one step closer to owning a credit card that can help you rebuild or strengthen your credit. I’ve walked you through how it all works, from understanding what the code means, how to use it properly, and what to expect once you apply. The process is smoother than you might think.