Chargeback PayPal Friends And Family Through Wells Fargo. Once you send money using PayPal Friends and Family, it’s like handing over cash in an envelope. You lose the safety net. Now, you might be wondering: Can you get money back from PayPal if sent friends and family? Well, technically speaking, PayPal doesn’t offer buyer protection for these types of payments. That’s the big catch.

Friends and Family (F&F) is meant for people you know and trust. It’s supposed to be used when you’re splitting dinner bills, sending birthday money, or helping your cousin with rent. It’s not designed for business transactions. But I get it, we’ve all been tempted to use it to avoid the extra fee.

So what happens when things go wrong? Maybe you sent money to someone who promised to ship something, and now they’re ghosting you. Can you do anything? Here’s the honest truth: it’s really tough, but not impossible.

You can try contacting PayPal support. If you have proof of deception, like a text where they say they’ll send the product, they might help. But they’re under no obligation.

Now, if you funded that PayPal payment with your Wells Fargo debit or credit card, there may still be hope (we’ll dig into that later). But straight through PayPal? You’re mostly out of luck unless they make an exception.

The takeaway? Be very cautious when using F&F. Because once it’s gone, it’s almost always gone for good.

- Advia Credit Union Login – How to Access My Advia Account

- Does Jack In The Box Accept EBT

- Card.tremendous.com Activate – Activate a Tremendous Visa Card

- Login Mypaymentvault com Activate – Activate Your Card

- How to Regain Access of Robinhood Account

- Blazecu com Login – Log into My Blaze Account

- How to Apply for a Cash App Card

- Cash a Check Online Instantly Without Ingo

- OneMain Financial Brightway Credit Card – Benefits, Features & Application

Can You Do a Chargeback on Wells Fargo?

Here’s where things get interesting. Can you do a chargeback on Wells Fargo? The short answer? Yes. But the longer answer is it depends.

Wells Fargo allows you to dispute charges made with your debit or credit card. If your PayPal Friends and Family payment was funded by one of those cards, you might be able to file a chargeback directly with the bank. This means Wells Fargo would review your claim, contact PayPal, and potentially refund your money.

But, and it’s a big but, they’re not just handing out money left and right. Wells Fargo looks closely at the nature of the transaction. If they see that the payment was made using PayPal Friends and Family, they’ll likely ask: “Was this a personal gift or a business deal disguised as one?”

If you lied and said it was for “friends” when it was really a business transaction, they might deny the claim. On the other hand, if you can show that you were scammed, or misled, you may have a shot.

It’s also important to file your dispute as soon as you suspect fraud. The longer you wait, the harder it gets. In my experience, Wells Fargo was quick to respond, but they asked for a lot of documentation: screenshots, emails, proof that the other party didn’t deliver, etc.

So yes, you can do a chargeback through Wells Fargo, but only if your claim is solid and you didn’t violate the terms by misusing Friends and Family payments.

Do Banks Chargeback PayPal?

Banks like Wells Fargo can initiate chargebacks even when PayPal is the payment processor. This might surprise some folks, but if you funded a PayPal payment with your bank’s card, that bank has the right to dispute the charge on your behalf.

Now, you might be wondering: Do banks chargeback PayPal automatically if I ask? Not quite. They follow a process.

When you file a chargeback with Wells Fargo, they don’t just yank the money out of PayPal’s pocket. Instead, they contact PayPal, who then contacts the seller. It becomes a whole chain of back-and-forth that can take days, or even weeks.

From what I’ve seen, PayPal hates chargebacks. Why? Because they lose control of the resolution process. Normally, if you file a complaint directly with PayPal, they mediate. But once the bank is involved, PayPal has to comply with their investigation.

If you do win the chargeback, PayPal will almost certainly ban or limit your account. It’s their way of saying, “You broke our process.” I’ve seen accounts frozen for months after a successful bank chargeback.

So yes, banks can issue a chargeback on PayPal transactions, but there are consequences. It’s not always the smoothest road, but if you’ve truly been scammed, and the evidence is on your side, it might be the only option left.

Does Wells Fargo Handle Chargeback Disputes?

This one’s a common question: Does Wells Fargo handle chargeback disputes? Absolutely, yes. And compared to some other banks, they’re actually pretty responsive.

When you call Wells Fargo or file a dispute online, they’ll assign your case to a team that specializes in fraud and disputed charges. If it involves PayPal, they’ll dig into the transaction details and ask you to provide evidence. This could include:

- Emails or messages with the seller

- Screenshots of what was promised vs. what you received (or didn’t receive)

- Proof that you never authorized the transaction

Wells Fargo was fast, they gave me a provisional credit within a few days while they investigated. That’s one thing I respect about them, they don’t make you wait months just to feel heard.

However, if the payment was clearly labeled “Friends and Family,” they’re going to ask the tough question: Why didn’t you use PayPal Goods and Services? And you need a good answer. Because if you made it look like a personal gift, Wells Fargo’s hands may be tied.

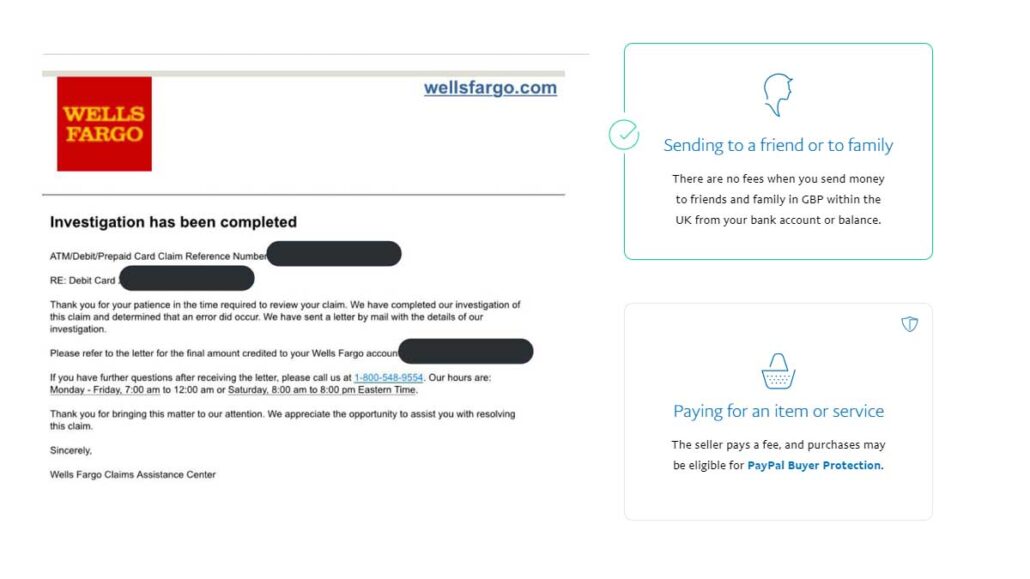

Their dispute process typically lasts 30 to 60 days. If they rule in your favor, you’ll see the money returned. If not, you’ll get a letter explaining why. Either way, they do handle chargeback disputes seriously.

How Much Does a Chargeback Cost at Wells Fargo?

Let’s talk dollars and cents. How much does a chargeback cost at Wells Fargo? Good news, if you’re a consumer (not a business), you usually won’t pay a fee to file a dispute. Wells Fargo generally doesn’t charge customers for initiating a chargeback investigation.

But here’s the catch: that doesn’t mean it’s free. There are indirect costs you should be aware of.

If your claim is found to be fraudulent or dishonest, Wells Fargo can revoke the provisional credit they gave you and potentially charge an overdraft fee if your account goes negative. Plus, if the chargeback involves a business PayPal account, Wells Fargo might assess investigation fees.

Also, don’t forget your reputation. Filing multiple disputes without strong evidence can flag your account for review. I’ve seen people’s accounts frozen because they looked like “frequent filers.”

For business accounts, it’s a different story. Merchants may face fees of $15 to $35 per chargeback and if the disputes keep piling up, Wells Fargo can raise those fees or even close the account.

So while it might not cost you anything up front, a chargeback isn’t something to file lightly. Think of it as your legal card you don’t pull it unless you’re ready to back it up.

Can I Get a Chargeback If a Friend Disputed a Payment?

You’d think that money between friends wouldn’t turn into a legal mess, but trust me, it happens more than you’d expect. One day you’re sending a quick $100 to help someone out, and the next, you’re blindsided by a dispute. So let’s clear it up: Can I get a chargeback if a friend disputed a payment?

Well, it depends on who disputed what. If you sent money via PayPal Friends and Family and your friend (or the person you thought was your friend) files a claim with their bank, that’s trouble. They might tell their bank, “I didn’t authorize this payment,” and just like that, your PayPal balance could go negative.

PayPal doesn’t offer protection to the sender in a Friends and Family transaction. So if the receiver (your “friend”) disputes it with their bank, and the bank issues a chargeback, PayPal often pulls the money directly from your account, no questions asked.

I’ve seen people lose hundreds this way, with no real recourse. Why? Because PayPal’s rules treat F&F payments like cash. Once it’s sent, it’s gone, unless the receiving bank agrees otherwise, which is rare.

If you’re the one trying to get a chargeback against a friend, and you funded the transaction through Wells Fargo, your only chance is proving fraud or deception. The bank doesn’t want to get involved in friendship drama. They’ll ask: Did the other person promise something? Were you tricked into sending money?

Bottom line? Don’t assume a “friendly” transfer means you’re safe. When things go south, banks and PayPal look at evidence, not relationships. Always treat even personal payments like a mini-contract, because that’s how the financial institutions will see it.

What Are Wells Fargo Chargeback Rights?

When we talk about rights, most of us think about free speech or voting. But financial rights? They matter just as much, especially when it comes to chargebacks. So here’s the deal: What are Wells Fargo chargeback rights?

Under federal law, particularly the Fair Credit Billing Act (FCBA) and Electronic Fund Transfer Act (EFTA), you’re protected from unauthorized charges, whether it’s through your credit card or your bank account. Wells Fargo, like other banks, follows these rules. That means if someone fraudulently charges your card or you were charged twice for the same thing, you can dispute it.

But and this is important you can’t dispute a transaction just because you regret it. If you sent money via PayPal Friends and Family to someone and later changed your mind, Wells Fargo is unlikely to side with you. However, if you never authorized the transaction or if you can prove fraud, that’s a different story.

Here are a few rights you do have:

- The right to file a dispute within 60 days of the charge appearing on your statement

- The right to a provisional credit while your case is under investigation

- The right to receive an explanation if your claim is denied

On the flip side, if you misuse the dispute system (say, you lie about what happened), Wells Fargo can revoke your credit, close your account, or even report you to fraud databases.

Be honest, provide strong documentation, and file as soon as you spot a suspicious transaction. Wells Fargo has systems in place to protect you, but you’ve got to use them the right way.

What Is the Wells Fargo Chargeback Process?

If you’re staring at a charge on your Wells Fargo statement and wondering what to do next, this section is for you. Let’s break it down: What is the Wells Fargo chargeback process?

Step 1: Identify the Issue

As soon as you spot a problem like an unauthorized PayPal Friends and Family charge, log into your Wells Fargo account and review the details. Make sure it wasn’t a subscription you forgot about or something you approved a while ago.

Step 2: Contact the Merchant (Optional)

In some cases, Wells Fargo recommends that you first try to resolve the issue with the merchant. For PayPal transactions, this means contacting the person or business you sent money to.

Step 3: File a Dispute

Go into your account online or call Wells Fargo’s customer service. Tell them you want to dispute a charge. Be specific, say it was a PayPal Friends and Family transfer, and whether it was authorized, fraudulent, or undelivered.

Step 4: Provide Documentation

This is where most people mess up. If you don’t give evidence, your claim probably won’t go anywhere. Provide:

- Screenshots of the PayPal transaction

- Communication with the seller (text, email, etc.)

- Proof of what was promised vs. what was received (or not received)

Step 5: Wait for the Investigation

Wells Fargo will usually give you a provisional credit while they investigate. This means the money comes back to your account temporarily.

Step 6: Resolution

The whole thing usually takes 30–60 days. They’ll send you a letter or notification with the final result. If you win, the money stays. If not, it gets pulled back.

Tips to Improve Your Chances:

- Be honest and detailed

- Act fast within 60 days

- Don’t file a dispute without evidence

- Save all communications with the seller

Understanding the process gives you more control and, in my experience, Wells Fargo handles these cases professionally if you give them something to work with.

Can Wells Fargo Reverse a Chargeback?

It feels great when you see that provisional credit land in your account. It’s a little like winning a mini-lottery. But don’t celebrate just yet, Can Wells Fargo reverse a chargeback? Yes, they absolutely can.

When you file a dispute, Wells Fargo gives you a temporary refund while they investigate. But here’s the catch: if they decide that your claim isn’t valid, maybe due to weak evidence, or because the transaction was authorized, they’ll take that money right back.

And believe me, they do it fast.

So yes, Wells Fargo can and will reverse a chargeback if they find that the dispute doesn’t meet their criteria.

To avoid this, make sure your dispute is airtight. Give them:

- Transaction IDs

- Screenshots of broken promises

- Dates and timelines

- Emails or chats showing you were scammed

If they still reverse it, you can appeal, but only if you have new evidence. So prepare well the first time.

FAQs

Can you chargeback PayPal Friends and Family through bank?

Yes, if you used a bank account or card (like Wells Fargo) to fund the transaction, you may file a chargeback. But success depends on the details and evidence.

Can you get money back from PayPal if sent Friends and Family?

Usually no. PayPal does not offer protection for Friends and Family transfers unless fraud is clearly proven.

Can you do a chargeback on Wells Fargo?

Yes, Wells Fargo allows chargebacks for unauthorized or fraudulent charges if they meet dispute criteria.

Can banks chargeback PayPal?

Yes. If you used a debit or credit card linked to your bank, the bank can file a chargeback through PayPal.

Does Wells Fargo handle chargeback disputes?

Yes, Wells Fargo has a dedicated dispute process for handling fraud and billing errors.

How much does a chargeback cost at Wells Fargo?

Generally, there’s no fee for consumers, but repeated or abusive disputes may result in penalties or account reviews.

Can I get a chargeback if a friend disputed a payment?

If they dispute a payment you sent, and it leads to a chargeback, PayPal may pull funds from your account. You can dispute it with your bank, but success varies.

What are Wells Fargo chargeback rights?

You’re protected under federal laws for unauthorized transactions and billing errors. But voluntary transfers via F&F might not qualify.

What is the Wells Fargo chargeback process?

You file a dispute, provide documentation, and Wells Fargo investigates. You may receive a provisional credit during this time.

Can Wells Fargo reverse a chargeback?

Yes, if the investigation finds the dispute invalid or lacking evidence, the bank can reverse the refund.

Conclusion

Let’s bring it all together. The moment you make a Chargeback PayPal Friends and Family Through Wells Fargo, you’re walking a tightrope between personal responsibility and legal protection. PayPal’s Friends and Family payments are intentionally designed without safety nets. You’re giving someone money with almost zero recourse, unless you funded that payment through a bank like Wells Fargo.

And even then, it’s no walk in the park. Wells Fargo will look at the transaction, your history, and your evidence before deciding anything. Can you win a chargeback? Absolutely. But only if your story checks out.

If you’re thinking about using PayPal Friends and Family to send money, ask yourself one question: Do I trust this person enough to hand them cash? Because that’s exactly what you’re doing.

Be smart, protect yourself, and know your rights. If you ever find yourself on the losing end of a sketchy transaction, Wells Fargo might just be your last line of defense, just be ready to fight for it.