If you’ve ever wondered how to navigate the Harborstone credit union login page, then you’ve come to the right place. I’m going to walk you through everything step by step in simple. By the end, you’ll feel like a pro using Harborstone’s online platform.

Security Service Credit Union Login – Manage Finances Online

Fortera Credit Union Login – Access Your Account

Sikorsky Federal Credit Union Login – Secure Access

IQ Credit Union Login at iqcu.com

Your Legacy Federal Credit Union Login – Secure Access

Team One Credit Union Login – How to Access Credit Union Account

Minnco Credit Union Login – Log in to Your Minnco Credit Union Account

OneMain Financial Brightway Credit Card – Benefits, Features & Application

Dickssporting Goods Credit Card Login – Secure Access

Bed Bath & Beyond Credit Card Login – Secure Access

What is Harborstone Credit Union?

So, you might be thinking: What exactly is Harborstone Credit Union? Well, Harborstone is a member-owned financial institution headquartered in Tacoma, Washington, often referred to as Harborstone Credit Union Tacoma WA. Unlike big banks, Harborstone is structured as a co-op. This means when you become a member, you own part of the credit union. Cool, right?

Members benefit from lower fees, competitive loan rates, and a sense of community because profits are returned to you, not outside shareholders. It’s like banking with your neighbours, but with digital convenience. Harborstone focuses on helping members reach their financial goals through savings, loans, mortgages, and online services.

Harborstone CU Online Banking Overview

Benefits of Banking Online with Harborstone

Let’s talk perks. When you use Harborstone Credit Union online banking, you get a toolbox of useful features:

- 24/7 account access: Check balances, transfer funds, and view statements whenever you want.

- Easy bill pays: Say goodbye to stamps, schedule recurring payments, or one-time transactions in a snap.

- Mobile banking convenience: Everything on your phone! Check balances, make deposits, or send money via peer-to-peer services.

- Account alerts: Get notified when transactions occur or your balance dips below a certain level.

- Secure messaging and support: Need help? Use secure messaging to talk with Harborstone reps directly online.

I find this digital toolbox incredibly empowering. No standing in line, no limited hours until my coffee spills.

Who Can Use Harborstone Online Banking?

Great question. Whether you’re opening a savings account, getting a loan, or already have a Harborstone Visa, you can sign up for online banking. It’s available to all members with a Harborstone account. You just need:

- A membership account (like a share draft or savings account).

- Valid personal identification (SSN, driver’s license, etc.).

- Basic internet access, which you’re using now. 😉

Even if you’re new to banking or tech, the login process is straightforward with clear prompts and security measures. Harborstone designed it that way to feel familiar, safe, and helpful.

Accessing the Harborstone Credit Union Login Page

Step‑by‑Step Login Process

Logging in is quick! Here’s how it usually goes:

- Visit harborstone.org: You’ll see the homepage. The “Login” or “Online Banking” button is typically top-right.

- Select the account type: Choose between a personal or business login.

- Enter credentials: Input your username or account number and your password.

- Multifactor authentication: If enabled, you may receive a code by text, email, or authenticator app.

- Access your dashboard: Once authenticated, you’ll land on your account summary.

From here, you can view balances, make transfers, pay bills, set alerts, or deposit checks, all from the Harborstone Credit Union login page. It’s smooth, secure, and gives peace of mind.

Troubleshooting Common Login Issues

Sometimes tech hiccups happen. Here’s how to handle them:

- Forgot password or username? Click the “Forgot Username” or “Forgot Password” link on the login page and follow the recovery steps using your email and SSN.

- Locked account? After several failed attempts, Harborstone may lock your account. You’ll need to contact member services via phone or secure chat to reset.

- Multifactor issues? If you’re not receiving codes or can’t access your authenticator app, the support team can help reset your method.

- Browser or network errors? Clear your browser cache, update your browser, or try another device or network (Wi-Fi vs. mobile data). If trouble continues, reach out to Harborstone support.

You might feel a bit frustrated if the login doesn’t work. But Harborstone support is usually quick to respond and walk you through resolving it safely.

Signing Up for Harborstone Online Banking

How do I sign up for Harborstone online banking?

To get started, here’s what you do:

- Go to harborstone.org and find the signup link often labelled “Enroll in Online Banking.”

- Provide your account number or membership ID, along with personal info like SSN and birthday.

- Choose a username (maybe your name + a number) and a strong password.

- Set up multifactor verification via text, email, or an authenticator app.

- Accept terms and submit.

- You’ll be guided back to the Harborstone Credit Union login page to access your new account.

And just like that, you’re digitally connected. You’ll immediately see your accounts, statements, and transaction history ready for online convenience.

Eligibility and Requirements

Pretty simple. To enroll, you need:

- A Harborstone membership with an active checking or savings account.

- Personal identification info (SSN, driver’s license, etc.).

- A unique username and strong password.

- A phone number or email for verification.

- Basic internet access or a mobile device.

There’s no fee for Harborstone online banking, just free, easy access to your financial life.

Features of Harborstone Credit Union

What are the key features of Harborstone Credit Union?

Alright, so now that you’ve got an idea of how to log in and what the transition means, let’s talk about why Harborstone CU stands out. It’s not just another bank trying to charge you for every little thing. This is a credit union that puts its members first. Here are the features that shine:

1. No or Low Fees

You won’t be bombarded with fees. Basic checking accounts? Usually no monthly maintenance charges. ATM withdrawals? Often free if you stick with the partner network. Overdrafts? They have flexible options and even alerts so you don’t get caught off guard.

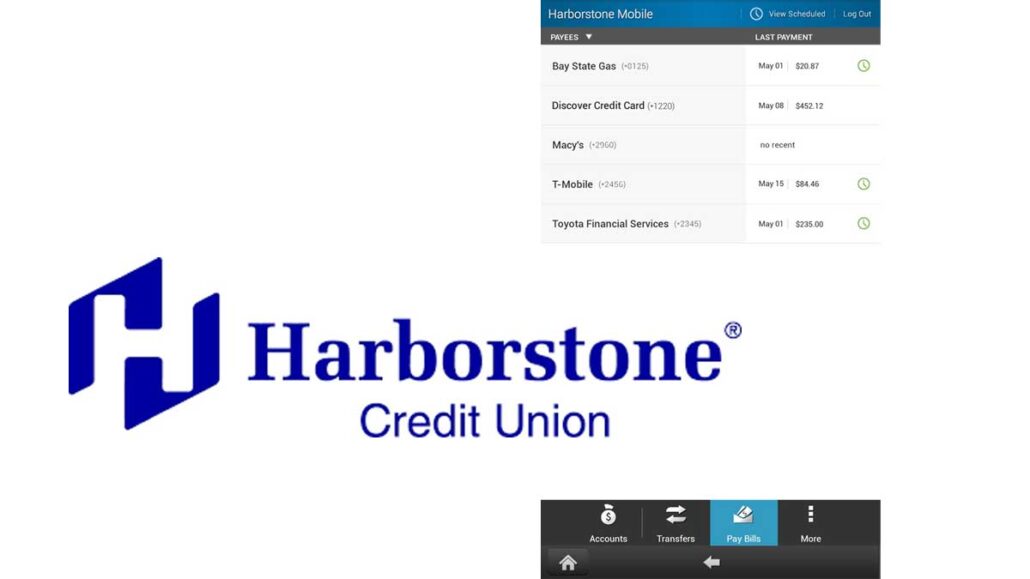

2. Online and Mobile Banking

The harborstone credit union online banking platform is fast and user-friendly. You can:

- View balances and recent transactions

- Transfer money between accounts

- Pay your bills

- Deposit checks via the mobile app

- Track your credit score and set budget goals

Especially, the alerts give you peace of mind. For example, you get notified if my balance drops below a set amount. No more surprises.

3. Great Loan and Credit Card Rates

Looking to finance a car? A home? Maybe a personal loan for an emergency? Harborstone offers competitive interest rates, and its application process is simple. It’s all available through your online account once you’re logged in.

Speaking of credit cards…

4. Harborstone Credit Card Access

If you have a Harborstone credit card, you’ll love how easily you can manage it through the same portal. You can:

- Check balances

- Make payments

- Set up autopay

- Track spending

We’ll cover that in more detail in the next section.

5. Friendly Customer Support

Harborstone’s staff are actually helpful. You can contact them through live chat, email, and phone, and you’ll be impressed by the response time. They talk to you like a real person, not like a script.

6. Financial Education and Tools

On their website, there’s a whole section dedicated to financial literacy. Whether you’re saving for college, managing credit, or buying a home they’ve got free resources, calculators, and guides.

Overall, the member-first mindset, strong online tools, and thoughtful services make Harborstone feel like more than a place to park your money.

Managing and Using Your Harborstone Credit Card

How do I use my Harborstone credit card?

Using your Harborstone credit card is simple, and managing it online is even easier. You can log in through the Harborstone Credit Union login page, and once you’re in, everything is at your fingertips.

Here’s what you can do with your card:

Make Purchases Online or In-Store

You can use your Harborstone Visa or Mastercard just like any other credit card, wherever those logos are accepted.

Track Spending by Category

Within online banking, you’ll find spending categories like groceries, entertainment, and utilities. This helps if you’re trying to stick to a budget or figure out where your money is going each month.

Set Up Alerts

You can choose to get alerts when:

- A transaction goes over a certain amount

- You’ve purchased your usual spending location

- A payment is due

This is perfect if you want to stay on top of your budget or protect against fraud.

Make Payments

Pay off your balance directly from your checking account. You can even set up auto-pay, so you never miss a due date. There’s also the option to pay more than the minimum helpful if you’re trying to knock down your balance fast.

Report Lost or Stolen Cards

If your card goes missing, you can freeze it or report it through the mobile app or website immediately. That’s real-time protection.

If you’re wondering whether this card earns rewards, yes, some versions do. You’ll need to log in and check which one you have. If you’re not sure, Harborstone’s team can explain the benefits that come with your specific card.

And finally, managing your Harborstone card is easier with the mobile app. Whether you’re on the go or just curled up on the couch, it’s all right there on your screen.

Mobile App Features and Access

Banking on the Go with the Harborstone App

Here’s what you can do right from your phone:

- Deposit checks by snapping a pic no need to hit the ATM or branch.

- Transfer funds between your Harborstone accounts or to another member.

- Pay bills on the fly, even schedule recurring ones.

- Set alerts for account activity, large transactions, or low balances.

- Apply for loans or credit cards right in the app.

- Check your credit score with free integrated tools.

The app interface is intuitive. You won’t be swiping around aimlessly trying to find your balance. Everything is clearly labelled, and setup takes just a couple of minutes after you log in for the first time via the Harborstone Credit Union login page.

If you’re like me and always misplace your debit card, the app even lets you freeze or unfreeze your card instantly. No stress. Just tap, and it’s locked.

Setting Up Alerts and Notifications

Stay Informed, Stay Secure

Real-time account alerts. These little messages can have saved you more times than you can count. Whether it’s catching a surprise subscription charge or making sure you don’t overdraft, the notifications are spot-on.

You can set alerts for:

- Balance thresholds (e.g., under $100)

- Large purchases

- Incoming deposits (great for knowing when your paycheck hits!)

- Unusual activity especially important if you’re worried about fraud

- Loan payment reminders

They come via email, text, or inside the app whichever you prefer. You control the settings right from your Harborstone online dashboard.

And here’s the best part: these alerts are customizable. You don’t have to turn on everything, just what matters to you. For me, I track spending and deposits, while some of my friends focus on payment reminders.

It’s like having a financial assistant in your pocket without paying a dime.

Contacting Harborstone Credit Union Support

Sometimes we just need to talk to a human. Whether you’re having trouble with the Harborstone cu login, resetting your password, or figuring out where a transaction came from, Harborstone’s support team is on point.

Here’s how you can reach them:

- Phone support: Available during business hours, and they’re friendly, not just “press 5 to wait another hour” friendly.

- Secure messaging: From inside your online banking portal, you can send a message and usually get a reply in less than 24 hours.

- In-person help: Harborstone has branches throughout Tacoma, WA, and surrounding areas.

- Live Chat: Their website often has a live chat bubble where you can get quick answers.

You can contact them many times, especially if you want to transition from an older account, and every time, they resolved my issue fast without jargon or judgment.

FAQs

How do I sign up for Harborstone online banking?

To enroll, go to harborstone.org, click “Enroll in Online Banking,” and follow the prompts. You’ll need your member number, SSN, and some contact info to get started. It’s quick and free!

What happens if I join Harborstone Credit Union?

You become part-owner! You gain access to low-fee banking, great loan rates, local service, and free tools like mobile banking, credit monitoring, and community events. It’s more personal and cooperative than a traditional bank.

What is Harborstone Credit Union?

Harborstone is a member-owned credit union based in Tacoma, WA. It offers banking services like checking, savings, loans, credit cards, and mortgages with a focus on community support and financial wellness.

What are the key features of Harborstone Credit Union?

Key features include free online banking, a powerful mobile app, low-interest loans, credit card access, strong fraud protection, personalized alerts, and member-only benefits like financial coaching and discounts.

How do I use my Harborstone credit card?

Log into your online banking account, navigate to your credit card section, and manage everything—payments, balances, spending categories, and more. You can even set alerts or lock your card in the mobile app.

When is First Sound Bank transitioning to Harborstone Credit Union?

The transition began in late 2024 and continues into 2025. Customers will receive new credentials, access to Harborstone’s systems, and updates via email or mail. Contact support if you haven’t received yours yet.

Is Harborstone Credit Union only for people in Tacoma, WA?

Nope! While it’s based in Tacoma, membership is open to residents across Washington state, including those affiliated with military, education, and select employer groups.

Can I use Zelle with Harborstone CU?

As of 2025, Harborstone doesn’t directly support Zelle—but they offer other person-to-person payment options inside the app. Check the latest updates online for new service integrations.

Does Harborstone charge overdraft fees?

Yes, but they’re typically lower than big banks. They also offer overdraft protection options and alerts to help you avoid charges.

Conclusion

The bottom line? If you’re looking for an online banking experience that’s user-friendly, secure, and backed by real human support, Harborstone Credit Union login delivers.

With the transition from First Sound Bank now underway, and services expanding across Harborstone cu, you get a lot more than just an account. You get access to a trusted team, cutting-edge tools, and the kind of financial partnership that makes banking feel personal again.

Whether you’re checking balances, managing a credit card, or planning your financial future Harborstone’s got you covered. And with the online portal, mobile app, and customer-first service, it’s truly never been easier.