Trying to log in to your Lafayette Federal Credit Union login account, but overwhelmed with the process. But guess what? It’s way simpler than it looks. Whether you’re a longtime member or brand new to the credit union world, understanding how to access and use your Lafayette Federal online account can truly make your banking life easier.

This guide will walk you through everything, like how to create your account, how to sign in, what features are available, and even what to do when the login just won’t work. I’ll break it all down in plain English, just like I wish someone had done for me the first time.

- Cerulean Credit Card Login – Secure Online Account Access

- Iddeal Credit Card Login – Secure Access

- Johnlewiscreditcard.com/login – Manage Your John Lewis Credit Card

- Comenity.com Login Zales – Login to Zales Credit Card

- Minnco Credit Union Login – Log in to Your Minnco Credit Union Account

- OneMain Financial Brightway Credit Card – Benefits, Features & Application

- Dickssporting Goods Credit Card Login – Secure Access

- Bed Bath & Beyond Credit Card Login – Secure Access

- Scorerewards Credit Card Login – Access Dicks Sporting Goods Credit Card

- Big Star Credit Login – Logging to Big Star Credit Account

- Concora Credit Login – Manage Your Account Online

- Member One Federal Credit Union Login – Manage My Member One Accounts

- Advia Credit Union Login – How to Access My Advia Account

- Midas Credit Card Login – How to Log in to Midas Credit Card Account

What is Lafayette Federal Credit Union?

Lafayette Federal Credit Union, often abbreviated as LFCU, is a not-for-profit financial cooperative headquartered in Rockville, Maryland. It has been serving its members since 1935. Unlike the big-name banks that are focused on profits, LFCU is built around its members, which means you. Every decision, every service, and every rate is designed with the member’s benefit in mind.

They serve a wide range of communities, including federal government employees, international organizations, and local families. And even if you’re not in the DC area, don’t worry. LFCU offers membership nationwide through affiliate organizations.

A Quick Overview of Its Services

Now, what do they actually offer? A lot more than you might think. From checking and savings accounts to auto loans, mortgages, personal loans, and credit cards, they’ve got it all. But what really stood out to me is their online and mobile banking features. They’re not some clunky outdated system. LFCU actually provides an intuitive, smooth online experience.

With features like bill pay, mobile deposits, and real-time transaction alerts, I found that managing my money became a lot easier. The credit union also offers competitive interest rates on savings and lower rates on loans compared to the average big-name bank.

Why Should You Choose Lafayette Federal Credit Union?

Member-Centric Values

One of the things that drew me to Lafayette Federal was its genuine focus on members. You’re not just an account number, you’re a part-owner of the credit union. That means your voice matters. Every member has voting rights and a say in important decisions.

Unlike commercial banks, where profits go to shareholders, LFCU reinvests profits back into the credit union. That results in better rates and fewer fees for people like you and me. There’s something special about knowing your bank isn’t trying to squeeze every penny out of you. It’s refreshing.

Plus, they offer financial education tools, budgeting workshops, and savings challenges. I’ve personally used some of their tools, and it really helped me get my finances in order. They go beyond banking, they actually care about your financial well-being.

Benefits Over Traditional Banks

Let’s talk perks. Traditional banks have a lot of hidden fees maintenance fees, ATM charges, and overdraft penalties. Here are a few reasons why you should chose LFCU over a traditional bank:

- No monthly maintenance fees on most accounts.

- Higher interest rates on savings and CDs.

- Lower interest rates on loans and credit cards.

- Free access to over 30,000 ATMs nationwide.

- Mobile and online banking that actually works well.

Plus, their customer service? Top-notch.

Getting Started with Lafayette Federal Credit Union

How to Become a Member

You might be wondering, “Can I even join?” The answer is probably yes. Membership is open to several groups, including:

- Employees of certain government agencies.

- Employees and members of select organizations.

- Residents of select communities in Maryland, Washington, D.C., and Virginia.

- Or, you can simply join the Home Ownership Financial Literacy Council (for a one-time $10 donation) to become eligible.

You’ll just need your Social Security number, ID, and a way to fund the account.

Setting Up Your Online Account

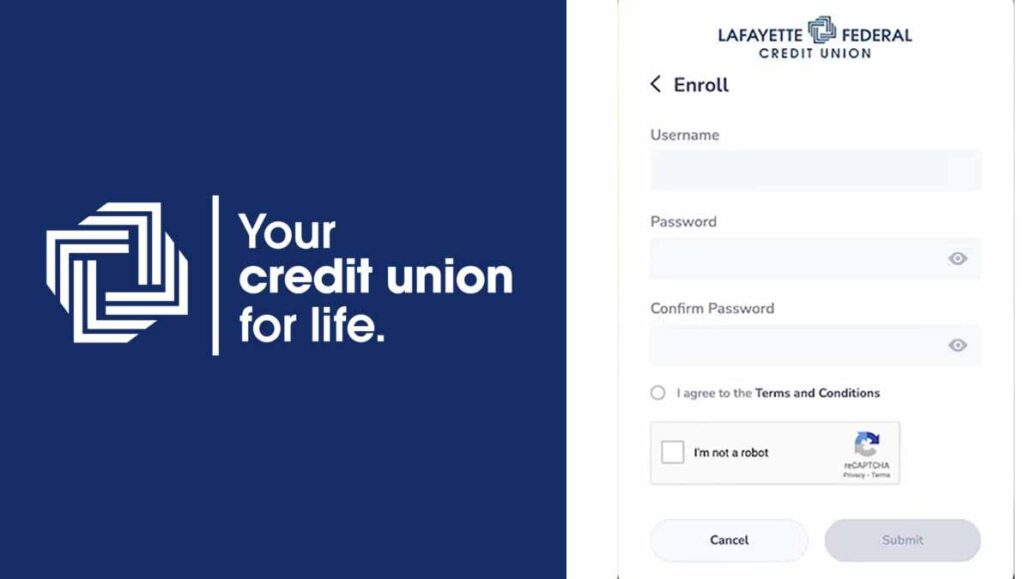

Once your membership is approved, setting up your Lafayette Federal Credit Union login account is your next step. This part is really important, so take your time and follow the prompts.

Here’s how to do it:

- Visit the official Lafayette Federal website.

- Click “Online Banking Login” and select “Enroll.”

- Enter your member ID and verify your identity.

- Choose a username and a strong password.

- Set up security questions and two-factor authentication.

Congratulation! You’re in. Once you finish the setup, you’ll be able to view your accounts, check balances, and even make a loan payment within minutes.

Lafayette Federal Credit Union Login – Step-by-Step Guide

Accessing the Website or App

Logging in might feel like a big task if you’re new to online banking, but it’s seriously just a few clicks. Here’s how you can do it:

- Go to the official website: www.lfcu.org.

- Click on the “Online Banking” button at the top-right.

- Enter your username and password.

- Complete two-factor authentication if prompted.

If you prefer doing everything from your phone, just download the Lafayette Federal Mobile App from the App Store or Google Play. Log in using the same credentials you created for online banking.

Troubleshooting Login Issues

Sometimes you’ll hit a snag. Maybe the site’s down. Maybe you forgot your password. I’ve been there, and here’s what to do:

- Forgot Password? Click on “Forgot Password” under the login box. You’ll receive a link via email or phone.

- Locked Out? If you try logging in too many times with the wrong credentials, you might get locked out. Just call customer service they’ll verify your identity and unlock your account.

- App Crashing? Uninstall and reinstall the app, then make sure your phone’s OS is up to date.

In rare cases, the website might be undergoing maintenance. Just try again later or check their social media for updates.

Features of Lafayette Federal Credit Union Online Banking

Account Overview and Tracking

Once you’re logged into your Lafayette Federal Credit Union login account, it feels like you’ve just walked into your own virtual bank branch. Everything you need is right there, laid out clearly and neatly. The dashboard is super easy to navigate even if you’re not a tech-savvy person like me.

You can view all your accounts in one place: checking, savings, credit cards, and any loans you’ve got with them. You can check your balances in real-time and scroll through your transaction history. It’s like having a detailed financial diary that never skips a beat.

They also offer custom account alerts. For example, you can set up notifications for when your balance goes below a certain amount and for every time a withdrawal over $100 happens. It gives you peace of mind knowing you’ll be alerted if something fishy is going on.

Bill Pay, Transfers, and eStatements

Paying bills used to be one of my most dreaded tasks. But with LFCU’s online bill pay, it’s become one of the easiest things to do. From your dashboard, you can add billers (like utilities, credit cards, etc.) and schedule payments ahead of time. You don’t even need to log into separate websites or write checks anymore.

Transfers are just as seamless. You can:

- Move funds between your own accounts

- Transfer to another member’s LFCU account

- Send money to external bank accounts (yes, even outside LFCU)

Plus, if you want to go green, you can sign up for eStatements. These are digital versions of your monthly statements and are available anytime. I love this feature because it declutters my physical mailbox and helps the environment at the same time.

Making Payments at Lafayette Federal Credit Union

Manual Payments

Making payments through your Lafayette Federal Credit Union login account is really straightforward. Whether it’s your credit card, personal loan, or even your mortgage, there’s a payment option for it online.

If you prefer to handle things manually, you can log in anytime, go to the payments section, select your loan or bill, and submit a payment instantly. The interface is clean and user-friendly, and it even shows your due date, current balance, and payment history.

You can also make a payment using:

- A different LFCU account

- A debit card

- An external bank account (after linking it)

Setting Up Auto-Pay

To save yourself from forgetting payments altogether, you can set up Auto-Pay. This is a lifesaver for recurring bills like loan installments or credit card payments.

Here’s how to set it up:

- Log into your account.

- Go to “Bill Pay” or the “Loan Details” page.

- Choose “Set Up Recurring Payment.”

- Pick the frequency (monthly, bi-weekly, etc.).

- Confirm and save.

Once it’s in place, you don’t have to do anything else. The system will take care of it for you. You’ll still get notifications before and after the payment happens, just in case you want to keep tabs on your account.

Mobile Banking with Lafayette Federal Credit Union

Mobile App Overview

These days, we’re all glued to our phones, so it only makes sense that banking should happen there, too. Downloaded the Lafayette Federal Credit Union mobile app on your phone, It’s like having a branch in my pocket 24/7.

Here’s what you can do on the app:

- Check your balances and transactions

- Transfer money

- Pay bills

- Deposit checks using your camera

- Find ATMs and branches near you

- Set up and manage alerts

- Chat with customer support

The app is available on both iOS and Android, and it’s regularly updated to fix bugs and improve features. One of the coolest features? Mobile Check Deposit. Just take a picture of the front and back of your endorsed check, submit it, and voilà, it’s in your account. No need to drive to a branch.

How Secure is Mobile Banking?

Now, I know what you’re probably thinking “Is it safe to do all this from my phone?” But Lafayette Federal takes security very seriously.

Here’s how they protect you:

- Biometric logins (Face ID, Touch ID)

- Two-Factor Authentication

- Encryption for all transactions

- Automatic logout after inactivity

- Real-time fraud alerts

Also, if your phone ever gets lost or stolen, you can remotely disable mobile banking access through the online portal or by calling customer support.

Common Issues with Lafayette Federal Credit Union Login

Why Is Lafayette Federal Credit Union Not Working?

Perhaps, you have been trying a few times to log in, and the site just wouldn’t load. Naturally, you panicked, was my account hacked? Was the system down? But most of the time, the issue is temporary and not on your end.

Common reasons why the site or app might not work:

- Scheduled maintenance (usually late at night)

- Internet connectivity issues

- Browser compatibility problems

- App needing an update

If this happen to you, checked their social media pages and find any update. They might be doing maintenance. So, if you ever run into issues, you can always start there.

How to Resolve App or Website Glitches

If you’re struggling with your Lafayette Federal Credit Union login, don’t worry. Here are a few tips that have worked for me:

- Clear your browser cache: especially if the site loads weirdly or freezes.

- Update your browser: older versions can sometimes break the login process.

- Restart your device: sounds simple, but it fixes a lot of app bugs.

- Reinstall the app: delete and reinstall it for a clean slate.

- Call customer support: if nothing works, they’ll reset your login or guide you through it.

Customer Service and Support

How to Contact Lafayette Federal Credit Union

One thing I truly appreciate about Lafayette Federal is how responsive and helpful their customer support team is. You’re not routed through 15 menus before getting help.

Here are your main contact options:

- Phone

- Email: Use their secure contact form on the website.

- Live Chat: Available through the website during business hours.

- In-Person: Visit one of their branch locations if you’re nearby.

They also have a Help Center on their website with articles, how-to guides, and answers to common questions. Their team is polite, patient, and actually listens. That’s rare these days, and it makes a world of difference when you need urgent help.

What to Do in Case of Fraud or Suspicious Activity

If you ever spot something off in your account, a weird charge, a failed login attempt, or a message that feels phishy, act fast. Fraud can spiral quickly if ignored.

Here’s what to do if you see an unrecognised $50 transaction on your card:

- Immediately locked your debit card using the mobile app.

- Called customer support to report it.

- Filed a dispute and got a temporary credit while they investigated.

- Changed your password and updated security questions.

The whole process is smooth, and your account was back to normal within days. Lafayette Federal took it seriously and kept me updated the entire time.

If you get suspicious emails pretending to be from the credit union, don’t click on anything. Instead, forward it to their security team and delete it right away.

Frequently Asked Questions (FAQs)

How do I access my Lafayette Federal account?

To access your account, go to www.lfcu.org and click “Online Banking Login.” You can also use their mobile app. Just enter your username and password, complete the two-factor verification, and you’re in.

Does Lafayette Federal offer online banking?

Yes! Their online banking is modern, easy to use, and secure. You can view your balance, transfer money, pay bills, deposit checks, and even apply for loans all from your computer or phone.

How do I make a payment at Lafayette Federal Credit Union?

Log into your account, click on the loan or bill you want to pay, and choose your payment method. You can pay manually or set up Auto-Pay so you never miss a due date. Payments can be made using internal accounts or external bank accounts.

What is Lafayette Federal Credit Union?

It’s a member-owned financial institution offering banking services like savings, checking, loans, and more. Founded in 1935, it’s known for putting members first, offering great rates, and delivering excellent customer service.

Why should you choose Lafayette Federal Credit Union?

Because they prioritize you. From low fees and great rates to top-tier customer support and secure digital tools, they offer a better alternative to traditional banks. Plus, you’re not just a customer, you’re a part-owner.

Why is Lafayette Federal Credit Union not working?

Sometimes the website or app might be down for maintenance. Other times, you might be facing internet or browser issues. Try restarting your device, updating the app, or checking their social media for announcements.

Conclusion

Logging into your Lafayette Federal Credit Union login account shouldn’t feel like cracking a secret code, and thanks to their user-friendly design, it doesn’t. Whether you’re checking balances, paying bills, or applying for loans, LFCU offers a streamlined and secure experience that’s built for real life.