If you’ve been wondering how to use login mypaymentvault com activate, you’re in the right place. It sounds techy, but trust me, it’s simpler than it looks. Whether you just received a bill notice from your medical provider, financial institution, or utility company, this little URL is your key to managing your payments securely and efficiently online.

Think of it like your digital payment assistant. It’s where your payment world becomes a lot less complicated. But here’s the catch: unless you activate your account the right way, you won’t be able to enjoy any of the conveniences it offers. That’s why this guide is here to walk you through the process like a friend, not a robot.

I’ll help you activate your account, avoid common pitfalls, and even troubleshoot login problems. I’m going to show you how login.mypaymentvault.com/activate can take the headache out of paying bills and keeping your finances in check.

- Emrewards.com Register Card Activate – Earn & Redeem Rewards

- Www.missionlane.com Activate – Step to MMission Lance Credit Card Activation

- Activate UHC Com Card Online Login – Quick & Secure Access

- www.activates3.com – How To Activate Your S3 Card

- www.perfectgift.com Activate – Activating Your PerfectGift Card

- Openskycc.com/activate – Activate Your OpenSky Credit Card Online

- Activate Zopa Credit Card – Easy Steps

- www.merrickbank.com/activate – Activate Your Merrick Bank Credit Card

- Nordstromcard.com/activate – Step to Activate Your Nordstrom Credit Card

- GoHenrycard.com Activate – Easy Steps to Get Your Child’s Card Ready

What is login.mypaymentvault.com/activate?

Alright, let’s get clear on what this is before diving in. Login mypaymentvault com/activate is a secure web portal that lets you activate your online account with MyPaymentVault. This platform is often used by healthcare providers, financial institutions, and service companies to streamline the way they send you billing information and collect payments.

In plain terms, this is the place you go when you want to make life easier. Rather than sorting through paper bills or waiting on hold with customer service, this portal puts everything you need in one secure online dashboard. Once you activate, you can pay bills, check your payment history, set up payment methods, and even receive electronic statements.

Here’s how it usually works: if your service provider uses MyPaymentVault, they’ll either send you an email or letter with instructions. That’s where the link “login.mypaymentvault.com/activate” comes in. You’ll click that, or type it into your browser, to start the activation process.

Who uses it? You might be surprised people from all walks of life. From patients managing hospital bills to small business owners streamlining vendor payments, this portal is the go-to for anyone looking to simplify payment management.

And the best part? It’s all online, available 24/7, and built with security as a top priority. That’s why activation is your first crucial step.

Why You Need to Activate Your MyPaymentVault Account

Now let’s talk about why activation matters. If you’re like me, you want fast, reliable access to your payment information without jumping through hoops. That’s exactly what login.mypaymentvault.com/activate gives you once you’ve completed the activation.

Think of activation as unlocking the full experience. Without it, you’re stuck. You won’t be able to log in, view your bills, or make payments online. More importantly, activating your account ensures that only you can access your sensitive billing information.

Here’s what you unlock with activation:

- Full access to your billing history: Know exactly what you paid, when you paid it, and what’s coming up.

- Secure payment processing: Pay directly through a trusted channel without sharing card info over the phone or by mail.

- Account customization: Add or remove payment methods, change your contact preferences, and more.

- Email and SMS notifications: Never miss a due date again.

Activation is more than a formality. It’s a way of verifying that you are the right person to receive and manage this information. It also enables the platform to communicate with you through verified channels, whether via email or phone.

Once you activate, you reduce the paper clutter in your life. You can get everything digitally now, no more digging through piles of bills or forgetting due dates. It makes adulting just a little easier.

So yes, activation is absolutely worth the few minutes it takes.

Step-by-Step Guide to login.mypaymentvault.com/activate

Let’s get to the real meat of the matter: how to activate your account. I’m going to walk you through it step by step, and I promise it won’t feel like decoding a rocket launch manual.

Step 1: Open the Website

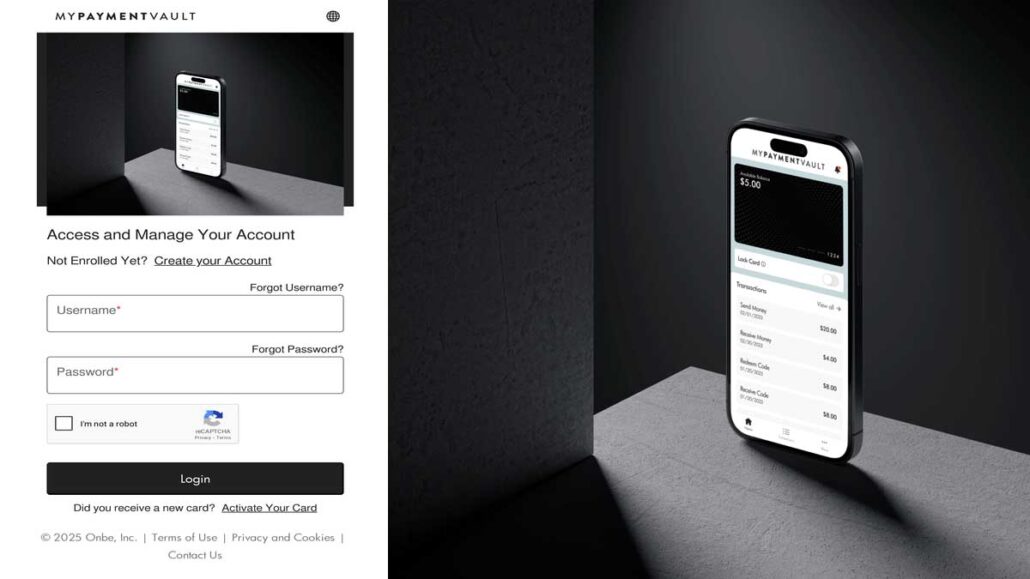

Open your preferred browser (Chrome, Safari, Firefox anything you like) and type in login.mypaymentvault.com/activate. Make sure there are no typos. You’ll land on the activation page, which is usually straightforward and clean.

Step 2: Enter the Required Information

Here’s what you’ll typically need:

- Your Account Number (usually provided by your service provider)

- A verification code (sent via email or SMS)

- Your email address associated with the account

- Sometimes, the last 4 digits of your phone number or SSN for extra security

Don’t worry, none of this is overly complicated. You’ll enter the information into the relevant fields and hit “Submit” or “Activate Account.”

Step 3: Create Your Login Credentials

Once verified, you’ll be prompted to create a username and a strong password. Choose something memorable but secure. I recommend using a password manager if you struggle with remembering passwords.

Step 4: Confirm Email or Phone Verification

They might send you a confirmation link to your email or a code to your phone. Complete that step to finalize the setup.

Step 5: Login and Explore

Now head back to the main login page, enter your new credentials, and boom, you’re in! You can now view your payment history, upcoming charges, and make payments.

Bookmark the login page so you don’t have to type the URL every time.

Common Issues During Activation and How to Fix Them

Let’s be real, things don’t always go smoothly. Sometimes the tech gremlins get involved. Here are the most common issues I’ve seen (or experienced myself) when activating at login.mypaymentvault.com/activate, along with how to fix them.

Issue 1: Invalid Credentials

If you’re getting an “Invalid Account Number” or “Verification Failed” message, double-check the details you entered. It could be something as simple as a typo. Make sure you’re using the correct account number from the bill or activation email.

Issue 2: Website Not Loading

Sometimes the site might not load properly. Try these steps:

- Refresh the page

- Clear your browser cache

- Try a different browser or device

- Check your internet connection

Issue 3: Activation Email Not Received

This one can be frustrating. If you’re waiting on a confirmation email:

- Check your spam or junk folder

- Make sure your inbox isn’t full

- Whitelist emails from MyPaymentVault

- If needed, request the email to be re-sent

Issue 4: Code Expired

The activation code you received may only be valid for a limited time. If it’s expired, request a new one from the original service provider or through the portal.

Issue 5: Account Already Activated

If it says your account is already activated, try logging in instead of repeating the process. If that fails, use the “Forgot Password” link to reset your credentials.

Stuck? Don’t hesitate to reach out to the support team listed on the activation page. They’re usually responsive and helpful.

Benefits of Using MyPaymentVault

Activating your account at login.mypaymentvault.com/activate opens the door to a world of convenience. The platform has made dealing with payments feel less like a chore and more like a quick task you can knock out on your coffee break. It’s not just about making payments, there’s a long list of perks that come with the service.

1. Streamlined Payment Experience

One of the most noticeable benefits is how easy it becomes to pay your bills. No more writing checks, mailing envelopes, or standing in line at payment centers. Just log in, choose your bill, pick your payment method, and you’re done.

2. Payment History at Your Fingertips

You’ll be able to access your complete payment history in a clear, organized layout. This comes in super handy during tax season or if you need to dispute a charge. Just scroll, find the transaction, and download a receipt if needed.

3. Multiple Payment Options

With an activated account, you’re not locked into one way of paying. You can:

- Use a debit or credit card

- Link your bank account

- Set up recurring payments

You can set up auto-pay for recurring bills, and it’s a lifesaver. No more late fees or stress about remembering due dates.

4. Real-Time Alerts and Reminders

Once activated, you can opt-in for notifications via email or SMS. These alerts let you know when a new bill is posted, when your payment is due, or if a payment was successful. It’s like having a personal assistant just for your bills.

5. Mobile-Friendly Access

Whether I’m on my phone, tablet, or laptop, the interface adapts perfectly. You can manage your account while you’re waiting in line, riding the bus, or even while traveling.

In a world where everything is going digital, using MyPaymentVault gives you an edge. You stay organized, you stay informed, and most importantly you stay in control of your money.

How MyPaymentVault Improves Your Financial Management

You might be thinking, “It’s just a payment site. How does that improve my financial health?” But here’s the thing: small changes in how we manage our money lead to big improvements down the road. And activating your account on login.mypaymentvault.com/activate is one of those small but mighty moves.

Better Visibility = Smarter Spending

The dashboard shows you exactly how much you owe, when it’s due, and what you’ve paid already. That kind of transparency helps you plan ahead and avoid overspending. You can avoid a few overdraft charges simply by checking your balance before making other purchases.

Helps You Stick to a Budget

With features like reminders and digital records, you’re more likely to follow through on your budget plans. You’ll know when a large bill is coming up and can plan accordingly, instead of being blindsided.

Reduced Missed Payments

Thanks to built-in alerts and recurring payments, you won’t have to worry about missed deadlines. That’s not just good for your stress levels, it’s great for your credit score too.

Simplifies Tax Preparation

Need to prove how much you paid for healthcare, utilities, or business expenses? Just download your payment history with a click. You no longer need to spend hours digging through statements. Now, it’s all in one place.

Reduces Paper Clutter

Let’s be real: organizing paper bills is annoying. Switching to digital bills through MyPaymentVault means no more paper piles on the kitchen counter. Plus, it’s better for the planet.

The simple truth? Good financial management starts with being informed and organized. And this platform delivers both in spades.

Is login.mypaymentvault.com Secure?

Security is a huge deal these days, and it should be. When I first heard about login.mypaymentvault.com/activate, the first question was: “Is it safe?” After all, we’re talking about personal financial data here. The good news is, this platform takes security seriously.

SSL Encryption

The site uses SSL (Secure Socket Layer) encryption. That means all data transferred between you and the site is scrambled, making it nearly impossible for hackers to read or intercept. You’ll know it’s secure because you’ll see the little padlock icon in the browser bar.

Two-Factor Authentication

When activating your account or logging in from a new device, you might be asked to verify your identity through a code sent to your email or phone. This extra step is a major win in protecting your account from unauthorized access.

Encrypted Payment Information

All payment data credit card details, bank accounts is stored in encrypted form and never shown in full. So even if someone got into your account (which is unlikely), they wouldn’t see your full payment details.

Trusted by Institutions

Many healthcare providers, government offices, and businesses rely on this platform. That kind of trust isn’t earned easily it means the platform has passed rigorous compliance standards for handling sensitive data.

Regular System Updates

The backend systems are updated frequently to protect against the latest threats. So, while you’re sleeping, the system is working to keep your data safe.

As someone who’s been using online payment platforms for years, I can confidently say this one check all the boxes for safety and peace of mind.

Can You Use MyPaymentVault on Mobile Devices?

Absolutely, yes. One of the things I love most about activating my account at login.mypaymentvault.com/activate is how smooth the mobile experience is.

Mobile Browser Friendly

There’s no official app (at least not yet), but the mobile browser version is so well-designed, you probably won’t miss it. Pages load quickly, the text is readable, and buttons are easy to tap without zooming in and out.

Responsive Design

The site automatically adjusts to the size of your screen. Everything from the login screen to the payment summary fits perfectly, no matter what device you’re on. You can even made a payment using just your phone’s mobile data and it worked like a charm.

Security on Mobile

You still get all the security features, even on mobile:

- SSL encryption

- Two-factor authentication

- Timeout after inactivity

It’s basically the same level of protection you’d expect from a banking app.

Pro Tips for Mobile Use:

- Bookmark the login page for quick access.

- Use a secure Wi-Fi network or mobile data when entering personal info.

- Log out after use to prevent unauthorized access if your phone gets lost.

In a world where everything’s on the go, being able to manage payments while commuting, traveling, or relaxing on the couch is a total game changer.

Troubleshooting Login Problems After Activation

You’ve activated your account at login.mypaymentvault.com/activate, but now you can’t get in? Don’t worry, it happens and usually, it’s an easy fix.

1. Forgot Your Password?

It’s more common than you think. Just click the “Forgot Password” link on the login page. You’ll receive an email with instructions to reset it. Make sure you check your spam folder if the email doesn’t show up right away.

2. Account Locked Out

Too many failed login attempts can lock your account for security reasons. If that happens, wait 15–30 minutes and try again. Or better yet, reach out to customer support for a manual reset.

3. Login Page Not Loading

Try the following:

- Refresh your browser

- Clear your cache and cookies

- Switch browsers (Chrome tends to work best)

4. Wrong Email or Username

Double-check if you used the right email address during activation. If you have multiple emails, try logging in with each one.

5. Browser Compatibility

Older versions of browsers may not support the full features of the site. Keep your browser updated for a smoother experience.

If all else fails, don’t hesitate to contact the support team listed on the portal. I’ve used their chat feature before, and they helped resolve my issue in less than 10 minutes.

How to Update Account Information on MyPaymentVault

So, you’ve activated your account at login.mypaymentvault.com/activate great! But life happens. Maybe you changed your phone number, got a new email, or need to update your payment method. Don’t worry, updating your account info is not only easy, it’s also crucial to keep things running smoothly.

1. Updating Personal Contact Details

Your email and phone number are how MyPaymentVault keeps in touch. If either changes, here’s how to update them:

- Log into your account

- Click on “My Profile” or “Account Settings”

- Select Edit next to your contact details

- Enter the new info and save

You may be asked to confirm changes via a verification code sent to the new contact info. That’s just to make sure it’s really you making the update.

2. Changing Your Payment Method

Maybe you got a new debit card or switched banks. Here’s how to change your payment method:

- Head over to the “Payment Methods” section

- Click Add New or Edit

- Input your new card or bank info

- Save and confirm

You can even nickname your payment methods like “Main Debit Card” or “Savings Account” to keep things organized.

3. Managing Multiple Billing Accounts

If you receive bills from different providers through MyPaymentVault (like your doctor and your dentist), you can often manage them all under one login. Just look for an option to “Add Another Account” under your dashboard.

4. Security Considerations

Whenever you update sensitive information, make sure you’re on a secure internet connection. Avoid public Wi-Fi and always log out when you’re done.

5. When You Can’t Make Changes

If certain sections are grayed out or unclickable, your provider may have restrictions in place. In that case, reach out to their billing department directly for assistance.

Keeping your account details current ensures you get alerts, confirmations, and access without hiccups. A few clicks now can save you a world of trouble later.

Tips to Stay Safe While Using login.mypaymentvault.com/activate

Online security is no joke especially when it involves your money. Activating your account at login.mypaymentvault.com/activate is safe, but how you use it also plays a huge role in keeping your data secure. Here are some no-nonsense tips I personally follow (and recommend you do too).

1. Use Strong Passwords

This one’s obvious but often overlooked. Don’t use your name, birth year, or “password123.” Use a mix of uppercase, lowercase, numbers, and symbols. Better yet, use a password manager to generate and store complex passwords.

2. Enable Two-Factor Authentication

If MyPaymentVault offers it (and many providers do), enable two-factor authentication. It adds an extra layer of protection by requiring a code sent to your phone or email in addition to your password.

3. Log Out When You’re Done

Always log out of your account after making a payment, especially if you’re using a shared or public computer. Leaving yourself logged in could allow someone else to gain access to your personal details.

4. Avoid Public Wi-Fi

Free Wi-Fi at coffee shops is convenient, but it’s also a hotspot for hackers. If you’re on the go, use mobile data or a secure VPN before logging into your account.

5. Watch for Phishing Attempts

Be cautious of emails that look like they’re from MyPaymentVault but have strange links or grammar errors. When in doubt, don’t click. Always go directly to login.mypaymentvault.com/activate by typing it into your browser.

6. Keep Your Browser and Device Updated

Outdated software can have security holes. Make sure your phone, tablet, or computer is updated regularly to protect against new threats.

Your safety online is in your hands. These simple habits can go a long way in protecting your sensitive information.

Customer Support and Help Resources

No matter how tech-savvy you are, sometimes you just need help from a real human. Here’s how to reach out if things go sideways after activating through login.mypaymentvault.com/activate.

1. Use the On-Screen Help or Chat

Many providers using MyPaymentVault include a Live Chat option right on the portal. You’ll usually see a small chat icon in the corner click that and type your question. Most times, you’ll be speaking to a real agent within minutes.

2. Check the FAQ Section

Before you make that call or send that email, scroll through the FAQ section. It’s surprisingly useful and may already have your answer.

3. Contact Customer Support

If you need more personalized help:

- Look for a “Contact Us” or “Support” link at the bottom of the page

- Use the email address or support phone number provided by your specific biller

- Be ready with your account number, email, and a brief explanation of the issue

4. Email Response Time

Most email inquiries get a response within 24–48 hours. Be as detailed as possible to avoid back-and-forth emails.

5. When to Call Instead

Some problems, like being locked out or needing to cancel a payment, are best handled over the phone. Just make sure to call during business hours.

Support exists for a reason, and in my experience, the team behind MyPaymentVault is patient, helpful, and quick to solve problems. Don’t hesitate to use them when you need to.

FAQs

What is login.mypaymentvault.com/activate used for?

It’s a secure portal to activate your MyPaymentVault account so you can manage billing, view payment history, and pay securely online.

Can I activate MyPaymentVault on my phone?

Yes, the site is mobile-friendly and works well on most smartphones and tablets.

What if I never received my activation email?

Check your spam folder first. If it’s not there, request a new one or contact support for help.

Is login.mypaymentvault.com a secure website?

Absolutely. It uses SSL encryption, two-factor authentication, and other top-tier security measures to protect your data.

How long does activation usually take?

The entire process usually takes less than 10 minutes. Just follow the prompts, verify your identity, and you’re good to go.

Conclusion

If you’ve made it this far, you now know everything you need to about login.mypaymentvault.com/activate. It’s more than just a link, it’s your gateway to simplified, secure, and smart payment management. From activation to making payments and updating your profile, every part of the process is designed to make your financial life a little easier.

Remember, activating your account is not just about access, it’s about security, convenience, and making your life more manageable. So don’t wait. Visit login.mypaymentvault.com/activate, follow the simple steps, and take charge of your financial life today.