If you just heard about Member One Federal Credit Union login, looking for a simple and secure way to manage your money online. If you’re busy and juggling multiple things you want your banking experience to be stress-free, especially when logging into your account. Member One FCU gets that. It offers a user-friendly digital platform where you can easily check your balances, pay bills, transfer funds, and manage your financial life without jumping through hoops.

Fortera Credit Union Login – Access Your Account

Sikorsky Federal Credit Union Login – Secure Access

IQ Credit Union Login at iqcu.com

Your Legacy Federal Credit Union Login – Secure Access

Team One Credit Union Login – How to Access Credit Union Account

Minnco Credit Union Login – Log in to Your Minnco Credit Union Account

OneMain Financial Brightway Credit Card – Benefits, Features & Application

Dickssporting Goods Credit Card Login – Secure Access

Bed Bath & Beyond Credit Card Login – Secure Access

What is Member One Federal Credit Union?

Member One Federal Credit Union is not your typical big-name bank. It’s a member-owned financial cooperative, which means when you open an account, you’re not just a customer you’re actually a part-owner. Founded in 1940, Member One has been serving communities in Virginia for over 80 years. It’s a not-for-profit institution, so instead of focusing on profits for shareholders, they focus on returning value to people like you and me.

What really sets Member One apart is how it blends that small-town service with modern banking tools. Whether you’re in Roanoke, Lynchburg, or anywhere nearby, you’ll find their commitment to personal financial health inspiring. From checking accounts and savings plans to home loans and investment tools, they’ve built a system that really supports the financial needs of everyday people.

So, the next time someone asks, “What is Member One Federal Credit Union?” now you know. It’s a people-first, service-driven, community-centered institution that puts you in control of your money.

Why Member One FCU is a Top Choice for Everyday Banking

You might be wondering, “Why should I choose Member One over a national bank?” That’s a fair question. I had the same hesitation at first. But the truth is, Member One FCU offers a ton of perks that many larger banks simply can’t match.

Member-Focused Benefits

Here’s what really caught my attention: Member One Federal Credit Union is all about YOU. Since it’s a not-for-profit institution, its main goal is to help you, not to squeeze out fees and upsell you unnecessary products.

- Lower Loan Rates: You can save hundreds of dollars when you refinanced your auto loan through them.

- Fewer Fees: Goodbye, hidden service fees and outrageous ATM charges!

- Higher Savings Yields: You’ll actually earn something on your savings.

Plus, they offer shared branching with other credit unions, giving you access to thousands of locations nationwide. That’s a huge bonus if you travel or move frequently.

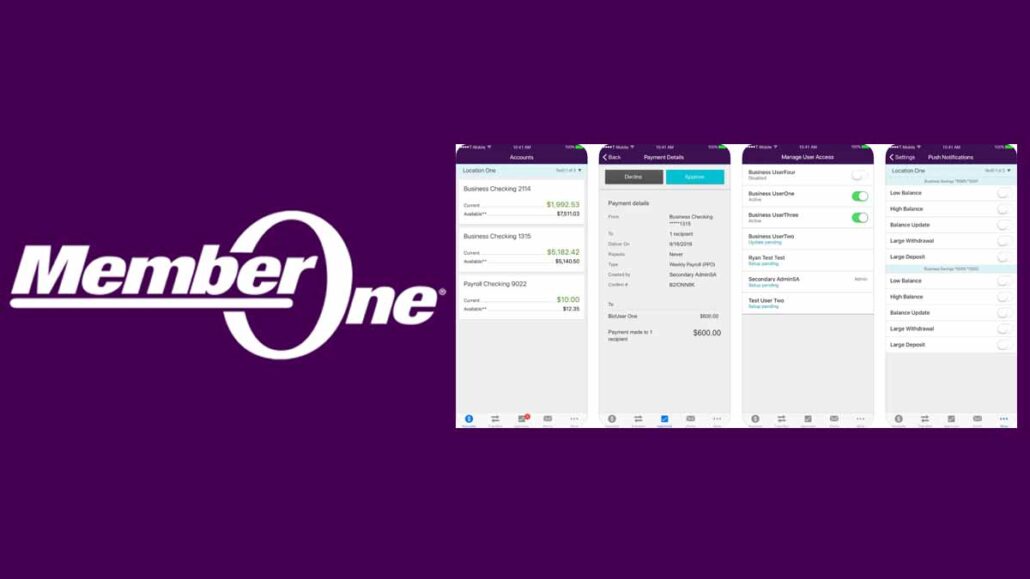

Digital Banking Convenience

The digital banking experience with Member One is honestly one of the best. Once you complete your Member One Federal Credit Union login, you unlock a full suite of online tools:

- Real-time account monitoring

- Mobile check deposit

- Online bill pay

- Easy fund transfers between accounts

- Credit score monitoring

And yes, they have a smooth mobile app. You can use it all the time to check your balance, move money around, and make quick loan payments. The layout is simple, responsive, and doesn’t crash like some other apps.

Personalized Financial Services

Member One doesn’t take a one-size-fits-all approach. They offer custom solutions based on your financial goals. Whether you’re saving for a wedding, planning for retirement, or paying off student loans, there’s a service tailored for your life.

Want to sit down with a financial advisor or loan officer? They’re there. Prefer doing everything digitally? That works too. Either way, you’re not just a number in the system you’re a valued member.

So if you’re thinking about switching banks, or opening your first account, I’d say give Member One a serious look. You’ll be surprised how different and better it feels to bank with someone who’s really on your side.

Step-by-Step Guide to Member One Federal Credit Union Login

Now that you’ve got the background, let’s dive into the part that brought you here, logging into your Member One FCU account. Whether you’re checking your balance from your laptop or paying a loan from your phone, logging in should be quick and painless.

How to Access Your Member One FCU Account

Alright, here’s the simple breakdown of how you can log in:

- Go to the official website: Open your browser and type in www.memberonefcu.com.

- Click on “Login”: You’ll find this in the upper right-hand corner of the homepage.

- Enter your credentials: Type in your username and password.

- Click “Sign In”: And just like that, you’re in!

Note: If you’re using a public or shared computer, be sure to uncheck “Remember Me” to protect your information.

The login system is secure and protected with multiple layers of encryption. You don’t have to worry about your sensitive data falling into the wrong hands as long as you keep your own login info private.

First-Time Login Setup Process

If you’ve just joined Member One and you’re trying to log in for the first time, don’t worry.

Here’s what to do:

- Click on “Enroll in Online Banking” under the login box.

- Provide personal details: This usually includes your account number, SSN, and birth date.

- Create your username and password: Make it strong but easy for you to remember.

- Set up security questions: These help verify your identity if you ever forget your password.

- Review and agree to terms: Once you do, your account is good to go.

You’ll receive a confirmation email, and from there, you can log in any time. I recommend bookmarking the login page for quick access in the future.

Troubleshooting Login Issues

Sometimes technology gets moody we’ve all been there. If you’re having trouble logging in, here’s what to check:

- Incorrect Username/Password: Double-check your spelling. Passwords are case-sensitive.

- Browser Compatibility: Make sure you’re using an updated version of Chrome, Safari, Firefox, or Edge.

- Cache/Cookies: Clear them if the page isn’t loading correctly.

- Two-Factor Authentication Issues: If your mobile number isn’t receiving verification codes, contact support.

Still stuck? Don’t sweat it. Just give Member One’s support line a call.

How to Reset Your Member One FCU Password or Username

We’ve all forgotten a password or username at least once. Maybe you were in a hurry or just haven’t logged in for a while. It happens. But with Member One Federal Credit Union login, resetting your access is designed to be stress-free and quick.

Resetting Your Password Online

Here’s what to usually do when you forget your password:

- Go to the login page on memberonefcu.com.

- Click the “Forgot Password?” link under the login box.

- Enter your username or email associated with your account.

- Follow the prompts to verify your identity.

- Create a new password and make sure it’s something you’ll remember!

After you reset your password, you’ll get a confirmation email or SMS if you’ve set up two-factor authentication. The whole thing takes maybe two minutes, tops.

Pro tip: Choose a password that’s strong but memorable. Use a mix of numbers, uppercase letters, and symbols something like B@nk1ngRocks2025.

Recovering a Forgotten Username

If you forgot your username instead, don’t worry, it’s just as easy:

- Click the “Forgot Username?” link on the login page.

- Enter your email and last four digits of your Social Security Number.

- Check your email for your username reminder.

It’s that simple. If you still can’t find it, just give their customer service team a quick call. They’ll verify your identity and help you recover your account safely.

Contacting Support for Help

Still stuck? Maybe the reset link isn’t working or you’re locked out. Here’s what to do:

- Call Member One FCU Support.

- Visit a local branch especially if you prefer face-to-face help.

- Use the Live Chat feature on their website for real-time assistance.

Their reps are super understanding. I’ve called during lunch breaks and after hours, and they’ve always had my back. You’ll get clear, jargon-free instructions and a solution that actually works.

How to Pay a Loan on MemberOneFCU

Managing loans can feel like a headache, especially when you have bills from all directions. But with Member One Federal Credit Union, paying your loan is honestly one of the easiest parts of your monthly routine. Whether it’s a personal loan, auto loan, or mortgage, they offer multiple, flexible ways to keep you on track.

Online Loan Payment Methods

Paying loans online is my go-to because it’s fast and convenient. Here’s how to do it:

- Login to your account via the website or mobile app.

- Go to the Loan Payment section.

- Select your loan and choose your payment amount.

- Confirm your payment method either from your checking, savings, or external account.

- Hit Submit done!

You’ll get an email confirmation and see the transaction in your account history almost instantly.

You can also make a one-time payment using their LoanPay Xpress portal even if you don’t have online banking set up. This is a handy tool for people who want to pay from an outside bank account or credit card.

AutoPay and Scheduled Payments

Want peace of mind? Set up AutoPay.

- Log in to your account.

- Go to the Recurring Payments section.

- Set your preferred date and amount.

- Choose your account (internal or external).

- Confirm and relax.

You can use AutoPay for your car loan, and never missed a due date. Plus, some loans might even offer rate discounts if you use AutoPay, so check with your loan officer.

If you don’t want full AutoPay, you can still schedule individual payments in advance, which is great when you’re planning around your payday.

Paying via Mobile App or In-Branch

Mobile payments are a lifesaver when you’re on the go. The Member One mobile app makes loan payments just a tap away:

- Open the app.

- Tap “Loan Payments.”

- Select your loan and amount.

- Confirm with fingerprint or Face ID (if enabled).

Prefer doing it the old-school way? You can always:

- Visit a branch and pay at the teller window.

- Use an ATM that supports loan payments.

- Mail a check with your account number and loan info.

How to Manage My Member One Accounts

Managing your finances should be simple, and with Member One Federal Credit Union, it really is. I love how they’ve made it easy to keep tabs on your accounts, whether you’re at home or out running errands. From checking and savings to loans and credit cards, every tool you need is right at your fingertips.

Using the Member One Online Banking Dashboard

The online banking dashboard is your command center. Once you complete your Member One Federal Credit Union login, you’re instantly connected to everything:

- View account balances at a glance

- Track recent transactions

- Transfer money between your Member One accounts or to external accounts

- Monitor your spending with categorized charts

- Set up account alerts so you never miss anything important

What I like best is the clean and simple layout. There’s no clutter, no confusion just useful tools designed to keep you in control.

If you’re someone who likes to know where every dollar is going, the “Spending Insights” section is a game changer. It breaks down your expenses into categories like groceries, gas, and entertainment, so you can tweak your budget if needed.

Mobile App: Banking in Your Pocket

Can I just say how much I rely on the mobile app? Whether you’re paying bills, checking your balance before grabbing coffee, or depositing a check, it handles everything without skipping a beat.

Here’s what you can do with the app:

- Deposit checks with just a photo

- Transfer money in seconds

- Make loan payments

- Lock/unlock your debit card

- View account history

- Set up alerts and reminders

The app supports biometric login (fingerprint or Face ID), which I love because it’s fast and secure. Plus, it’s available on both iOS and Android.

Managing Cards and Statements

In the dashboard, you can also:

- View eStatements instead of paper ones (great for the environment!)

- Set travel alerts for your debit/credit cards

- Report a lost or stolen card instantly

- Activate new cards without calling customer service

Need to dispute a transaction or spot something fishy? You can do that right from your dashboard or the app, no waiting on hold.

Bottom line: managing your Member One accounts is not only easy it’s empowering. You don’t need to be a finance whiz to take control of your money here.

Is Members 1st FCU Federally Insured?

Yes, Members 1st Federal Credit Union is federally insured by the National Credit Union Administration (NCUA). That means your money is protected up to $250,000 per individual depositor, just like it would be at a traditional bank insured by the FDIC.

Let’s break it down:

- Your savings, checking, and other deposit accounts are 100% safe.

- Even in the unlikely event the credit union fails, your money is covered.

- It’s backed by the full faith and credit of the U.S. Government.

This coverage gives me real peace of mind, especially during uncertain economic times. It’s like having a financial safety net.

Even better, Member One maintains a solid reputation for financial stability, with decades of trusted service and consistent growth. So not only is your money federally insured, it’s also in good hands.

What is Member One Federal Credit Union’s Routing Number?

Every time you set up direct deposit, transfer funds, or pay a bill online, you need one thing: the routing number. So here it is, plain and simple:

Member One Federal Credit Union Routing Number: 251483311

Let me quickly explain what it’s for:

- A routing number identifies your credit union and tells banks where to send your money.

- You’ll need it for ACH transfers, wire transfers, and direct deposit.

- It’s often used alongside your account number to complete a transaction.

You can find this number:

- On the bottom of your checks (first 9-digit number)

- In your online banking dashboard

- On the Member One FCU website under “Contact Us” or “Support”

If you ever have doubts, don’t guess. Just log in and verify it under your account info or call customer support to confirm.

FAQs

Where is memberonefcu located?

Member One Federal Credit Union is headquartered in Roanoke, Virginia, with multiple branches across Southwest and Central Virginia, including Lynchburg, Salem, and Franklin County.

What is Member One Federal Credit Union?

It’s a not-for-profit, member-owned credit union offering checking, savings, loans, and investment services to individuals and families across Virginia. It focuses on personalized service and community growth.

How do I pay a loan on memberonefcu?

You can pay online via your account dashboard, set up AutoPay, use the mobile app, or visit a branch. Payments can be made from internal or external accounts.

How do I manage my Member One accounts?

Through their online banking system and mobile app, you can check balances, transfer funds, pay bills, deposit checks, and monitor spending.

Is Members 1st FCU federally insured?

Yes, it is federally insured by the NCUA, which protects each member’s deposits up to $250,000.

What is Member One Federal Credit Union’s routing number?

The routing number is 251483311. It’s used for direct deposits, wire transfers, and other banking transactions.

Conclusion

Logging into your account with Member One Federal Credit Union login isn’t just about accessing your balance, it’s about stepping into a digital world designed around you. From stress-free account management to flexible loan payments and secure online banking, everything feels intentionally easy, reliable, and personal.

They combine hometown care with digital convenience, and it shows in every feature online, in-person, and through their mobile app.

Whether you’re new to banking or just tired of the corporate feel of big-name banks, Member One offers something better. It’s smart, secure, and sincerely built for real people with real goals.