Trying to access your Sesloc Federal Credit Union login page and not sure where to start? This is one of the issues of many users, juggling between apps, remembering passwords, and just wanting a secure and quick way to check my account balance. Online banking today isn’t a luxury, it’s a necessity. Whether you’re checking your savings, making a loan payment, or transferring funds, having a seamless digital experience is essential. That’s why SESLOC’s online banking platform matters.

I’m going to walk you through everything: logging in, fixing login problems, mobile access, and even resetting your password if you forget it (because let’s be honest, we all forget those once in a while).

Security Service Credit Union Login – Manage Finances Online

Fortera Credit Union Login – Access Your Account

Sikorsky Federal Credit Union Login – Secure Access

IQ Credit Union Login at iqcu.com

Your Legacy Federal Credit Union Login – Secure Access

Team One Credit Union Login – How to Access Credit Union Account

Minnco Credit Union Login – Log in to Your Minnco Credit Union Account

OneMain Financial Brightway Credit Card – Benefits, Features & Application

Dickssporting Goods Credit Card Login – Secure Access

Bed Bath & Beyond Credit Card Login – Secure Access

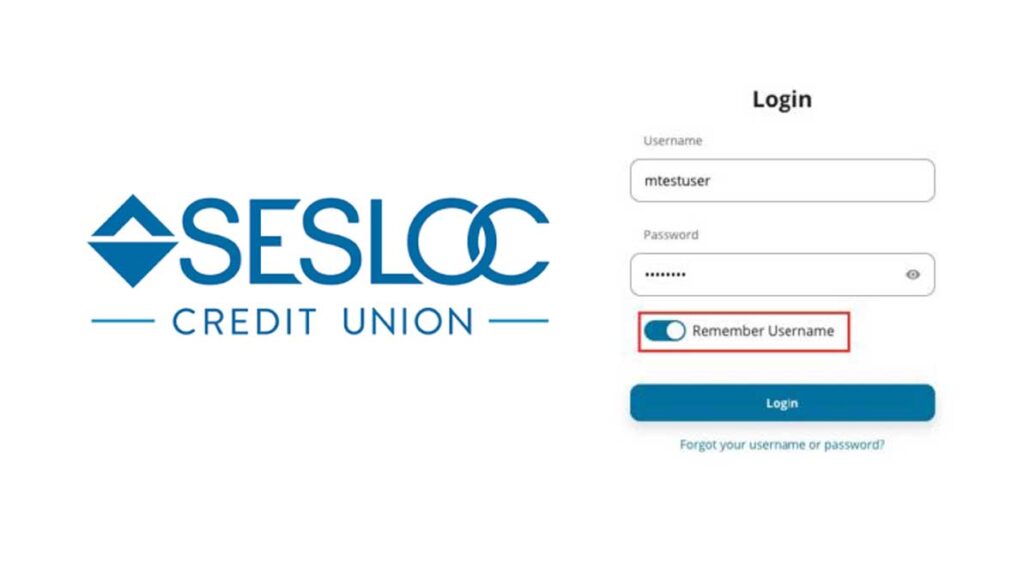

Step-by-Step Guide to SESLOC Federal Credit Union Login

How to Access the Login Page

Here’s how you do it right:

- Open your preferred browser (use Chrome or Safari).

- Type in the official website: www.sesloc.org.

- Look at the top right-hand corner of the page, you’ll see a green “Login” button.

Clicking that brings up the online banking login box. You’ll be asked to enter your Username and Password there. Make sure you’re on a secure connection (look for the padlock in your address bar) to avoid any issues with hackers.

If you’re using a mobile device, I recommend downloading the SESLOC app instead, it’s cleaner and optimized for smaller screens.

Logging in with Your Credentials

- Your Online Banking Username

- Your Password

Once you input those, hit “Login.” If all goes well, you’ll land on your dashboard, where you can see all your accounts, recent transactions, and any messages from SESLOC.

If it’s your first time logging in from that device, they may ask for a one-time security code. This usually gets sent to your email or phone. Don’t skip this step, it’s part of their enhanced security features.

Don’t save your password on public or shared computers. Always use a password manager to keep things safe and organized.

Troubleshooting Login Issues

Okay, let’s say you’re stuck. Maybe you forgot your password, or you’re getting a weird error message.

Here’s what usually helps:

- Forgot Password? Click the “Forgot Password?” link below the login box. You’ll need to verify your identity before you can reset it.

- Locked Account? If you tried the wrong password too many times, your account might be locked. In that case, just call SESLOC’s support phone number.

- Site Not Loading? Try clearing your browser cache or switching to another browser.

If none of that works, don’t be shy, reach out to their support team. They’re surprisingly friendly and responsive.

Creating Your SESLOC Online Banking Account

First-Time User Registration Process

If you haven’t created your online banking account yet, you’re going to need to register first. Don’t worry, it’s not complicated. Here’s how to do it:

- Head over to the login page.

- Below the login box, there’s a link that says “Enroll in Online Banking.” Click that.

- You’ll need to provide some basic information:

- Your SESLOC member number

- Social Security Number

- Date of birth

- ZIP code

After that, you’ll create a username and password. Be sure to pick something secure, a mix of uppercase, lowercase, numbers, and symbols works best.

This entire process takes less than 5 minutes if you’ve got your info handy. Once done, you’ll be able to log in and explore your online dashboard right away.

SESLOC Mobile Banking – Access On The Go

Downloading the SESLOC Mobile App

If you’re like me and prefer doing everything from your phone, you’ll be happy to know that SESLOC has a mobile banking app that’s user-friendly and quick. Whether you’re an Android fan or an iPhone devotee, the app is available on both Google Play and the Apple App Store.

Here’s how to get it:

- Go to your app store.

- Search for “SESLOC Mobile Banking.”

- Tap download and wait for it to install.

Once it’s on your phone, just open the app and log in using the same username and password you use on the website. If you want extra security (which I always recommend), enable biometric login, Face ID or fingerprint, depending on your device. It makes logging in faster and safer.

Features and Benefits of Mobile Banking

Now let’s talk about what you can actually do with the app, and it’s a lot. Here’s what you’ll love about it:

- Quick Balance Checks: You can view my account balance without logging in fully super handy when you’re in a hurry.

- Transfers Made Simple: Move money between SESLOC accounts or even to external banks.

- Mobile Check Deposit: Just snap a photo of your check and deposit it without setting foot in a branch.

- Pay Bills: Whether it’s utilities, rent, or a loan, you can schedule and send payments right from your phone.

- Secure Messaging: Need help? The app lets you chat with SESLOC support safely.

It’s basically like carrying a full-service bank in your pocket.

Managing Finances Anytime, Anywhere

What is most appreciated is the flexibility SESLOC mobile banking gives you. You are no longer tied to a desktop or forced to rush to the bank during office hours. Also, you can pay bills while waiting in line at the grocery store. You can transfer funds at midnight. It’s about freedom, doing things on my time.

The mobile app even sends me real-time alerts. you get notified when a payment goes through or if your account balance dips below a certain level. These alerts help you avoid overdrafts and keep tabs on your spending habits.

And if you’re someone who likes visual tools, the app has budget-tracking and spending graphs that show you exactly where your money is going. Honestly, this helped me cut down on unnecessary expenses because seeing it all laid out made it real.

Resetting SESLOC Online Banking Credentials

Forgotten Password? Here’s What to Do

If you’ve forgotten your SESLOC password, don’t sweat it. It happens to the best of us (more than I’d like to admit). Thankfully, SESLOC has a smooth password recovery process.

Here’s the quick fix:

- Go to the login screen.

- Click on “Forgot Password?”

- Enter your username and the email address linked to your SESLOC account.

They’ll send you a password reset link. Just follow the steps and choose a new password. It’s best to use something strong and unique don’t recycle old passwords. I like using a password manager to keep track of everything securely.

How to Recover a Locked Account

If you enter the wrong credentials too many times, SESLOC’s system will automatically lock your account. This is actually a good thing it’s their way of keeping your account safe from unauthorized access.

If you’re locked out, you have two options:

- Call SESLOC support: you can view their phone number online during business hours.

- Send a secure message through their online platform once you’re back in.

Their team usually responds quickly and will help verify your identity to unlock the account. I once had my account locked while traveling abroad, and they sorted it out in less than 15 minutes.

Updating Your Login Information

Sometimes, it’s not about forgetting, maybe you just want to change your username or password. Maybe you noticed suspicious activity and want to tighten things up. Here’s how to update your credentials:

- Log in to your online banking.

- Navigate to “Settings” or “Security.”

- Choose the option to update your username or password.

Make sure your new credentials follow best security practices:

- Use 12+ characters.

- Include symbols, numbers, and a mix of upper/lower case.

- Avoid personal info like birthdays or names.

Pro tip: Update your login credentials every few months. It’s a simple habit that adds a strong layer of protection to your financial life.

Online Bill Pay and Loan Payments at SESLOC

How to Pay SESLOC Loans Online

Paying loans online through SESLOC is not just easy, it’s a game changer. Gone are the days when you had to write checks or remember mailing addresses. Whether it’s an auto loan, personal loan, or mortgage, SESLOC gives you several ways to pay online.

Here’s how to do it:

- Log in to your SESLOC Online Banking account.

- Click on the “Payments” tab.

- Choose the loan account you want to pay.

- Select your payment source (another SESLOC account or an external bank).

- Enter the payment amount and confirm the date.

You can also use the SESLOC Mobile App to make payments. It’s just as easy, maybe even faster. And what you can love is the option to schedule recurring payments, so you never have to worry about missing a due date.

Always double-check the loan payment confirmation. It gives you peace of mind, especially if you’re making a large payment or paying extra toward your principal.

Setting Up Recurring Payments

Let’s talk about setting it and forgetting it, your favorite feature.

Here’s how you automate your SESLOC loan payments:

- Go to the Bill Pay section.

- Choose “Recurring Payments.”

- Pick the loan, set the amount, and choose the frequency (weekly, biweekly, monthly).

- Confirm and save.

The system handles everything from there. No late fees. No reminders. Plus, no headaches.

Automating your payments not only keeps you on track, but it has also improved your credit score over time. Consistency is key when it comes to building financial credibility, and SESLOC makes it a breeze.

Tracking Your Payment History

You probably want to know where every dollar is going. SESLOC provides a detailed payment history within your online dashboard.

Here’s what you can check regularly:

- Last payment amount and date

- Remaining balance on the loan

- Interest vs. principal breakdown

- Scheduled future payments

This helps you manage your budget and even make smarter decisions, like when to make extra payments or refinance.

If you ever need to download your history for tax purposes or budgeting software, SESLOC lets you export it in a few clicks. Super handy come tax season.

SESLOC Federal Credit Union Security Measures

How SESLOC Protects Your Data

Security is everything in online banking. And SESLOC takes it very seriously. When you first started online banking, your biggest concern was whether it was safe. Turns out, SESLOC uses top-tier security systems.

Here’s how they protect us:

- Encryption: All data sent between your device and SESLOC’s servers is encrypted using 256-bit SSL encryption.

- Multifactor Authentication (MFA): You’re required to verify your identity with a one-time code sent via SMS or email.

- Fraud Detection: Their systems monitor for suspicious activity and will flag or freeze an account if anything looks off.

Knowing all that gives me peace of mind every time I log in.

Best Practices for Secure Online Banking

Even with all those protections in place, we as users have a role too. Here’s how to keep your SESLOC account secure:

- Use strong, unique passwords and update them every few months.

- Avoid public Wi-Fi when logging into my account.

- Enable biometric login on the mobile app for an extra layer of protection.

- Monitor account activity regularly. You can check your transactions weekly just to be safe.

And remember: SESLOC will never ask for your full password or Social Security number over the phone or email. If you get a request like that, don’t reply. Call their fraud department immediately.

What to Do in Case of a Security Breach

Let’s say the worst happens, you think your SESLOC account’s been compromised. Don’t panic. Take these steps immediately:

- Log in and change your password if you still have access.

- Contact SESLOC support.

- Freeze or monitor your account for any unauthorized transactions.

- Enable fraud alerts and consider placing a temporary freeze on your credit.

The SESLOC team is well-trained to handle these situations quickly and discreetly. Trust me, you’re in good hands.

Customer Support and Contact Options

How Do I Contact SESLOC Online Banking?

Getting in touch with SESLOC’s support team is refreshingly easy. They’ve got a number of ways for you to reach them, depending on your preference.

Here’s what to use:

- Phone Support: Call their phone number for immediate help.

- Secure Messaging: From within your online account or app.

- Email: While it’s not for urgent issues, you can send general questions.

- Live Chat: During business hours, their website often has live chat support available.

The secure message centre is great for sensitive questions or account-specific help.

Hours of Availability and Support Channels

SESLOC’s regular business hours are:

- Monday – Friday: 9:00 AM – 5:30 PM

- Saturday: 9:00 AM – 1:00 PM

- Sunday: Closed

Their phone lines and in-branch services follow these hours, but the online banking and mobile app are, of course, available 24/7.

So even if you’re managing your money at 2 AM on a Sunday night, you can still access everything.

FAQs and Online Help Center

If you’re more of a DIY type, SESLOC has a robust online Help Center. It’s packed with FAQs, how-to guides, video tutorials, and troubleshooting tips. You can search by keyword or browse topics like:

- Account Setup

- Mobile Deposit Issues

- Online Bill Pay Instructions

- Lost or Stolen Card Reporting

The Help Center has saved me multiple calls. It’s simple, straightforward, and a huge time-saver.

Common SESLOC Online Banking Problems

Glitches, Bugs, and Outages

No system is immune to technical issues, and SESLOC’s online banking is no different. Here are some of the common problems:

- Login errors after a software update

- App freezing during check deposit

- Temporary service outages (usually fixed fast)

The good news is SESLOC usually posts real-time updates on their website or app whenever there’s a known issue. So you’re not left in the dark.

Troubleshooting Tips for Common Issues

If you’re running into problems, try these before calling support:

- Clear your browser cache if you’re on desktop.

- Restart your phone and relaunch the app.

- Delete and reinstall the app if it keeps crashing.

- Check that your internet connection is stable.

If all else fails, reach out to SESLOC support.

When to Contact Support

Sometimes, you just need a human. If your issue involves:

- Stolen cards

- Locked accounts

- Suspected fraud

- Loan payment errors

Call immediately. Don’t try to fix it on your own. SESLOC’s team is trained for exactly these kinds of situations.

FAQs

What banking services does SESLOC offer?

SESLOC provides checking and savings accounts, auto and home loans, business services, credit cards, student programs, and financial planning.

What is SESLOC Federal Credit Union?

It’s a not-for-profit, member-owned credit union serving California’s Central Coast since 1942. It offers a full range of financial services and is known for community engagement.

How do I contact SESLOC online banking?

You can call the phone number, send a secure message through your account, or chat live on their website during business hours.

Who insures SESLOC Credit Union?

SESLOC is federally insured by the NCUA, which protects your deposits up to $250,000 per account ownership type.

How do I pay SESLOC loans online?

Log in to your account, go to Payments, select your loan, and either make a one-time payment or set up recurring payments.

Is SESLOC improving their customer service?

Yes, they’ve added live chat, upgraded their app, and are actively listening to member feedback to improve the user experience.

Conclusion

If you’re looking for a safe, efficient, and community-driven place to manage your money, the Sesloc Federal Credit Union login portal is your golden key. It gives you full access to every service from checking your balance to paying off loans, right at your fingertips. I’ve used it, tested it, and even called support a few times, and I can say with confidence: it works, and it works well.

SESLOC stands out not just because of its tech, but because it cares about its members. From strong security to helpful staff, from mobile features to personalized loan support, it’s a complete package for anyone who values both convenience and integrity in a financial institution.